9:05 AM, 1st December 2015, About 9 years ago 53

Text Size

The Chancellor of the Exchequer’s 2015 Autumn statement put me in mind of a scene from the epic television series Game of Thrones.

The Chancellor of the Exchequer’s 2015 Autumn statement put me in mind of a scene from the epic television series Game of Thrones.

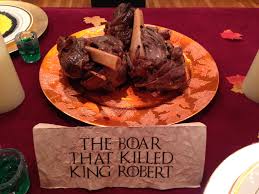

In the scene, a musician, captured for making mock of the fatal goring by a wild boar of the former king of Westeros Robert Baratheon, is being forced to re-perform his offending material before the new king, Joffrey Baratheon, and his court.

Upon completion of the final line of the song – “the lion ripped his b*lls off aaaaand… the boar did all the rest” – the boy-king Joffrey leads an applause of the performance and then openly toys with the musician as to which body-part to have amputated from him as punishment.

When the musician begs “Every man needs hands your Grace”, Joffrey merely smiles and chirps back “Good… tongue it is.”

My memory of this scene was triggered at the point of the Autumn Statement when George Osborne recalled being told of the unfairness of restricting mortgage-interest tax-relief for individual landlords. It was from this point in the speech, with barely-concealed mocking reference to such unfairness, that the Chancellor then proceeded to announce a 3% Stamp Duty surcharge on landlord house purchases: gutting and making yet further example of his chosen scapegoat before the Nation.

But at least we could presume in Game of Thrones that the poor singer got to keep his hands. Furthermore, the Osbornesque small print to this policy is that commercial property investors, with more than 15 properties, are expected to be exempt from the new charges. So rather than correcting the disparity in treatment between individual and corporate landlords, the Stamp Duty surcharge is set to exacerbate it. The twist to this “fair” announcement is therefore as dishonest as it is vindictive.

Based on the letters I have sent, and the letters sent by other parties that I have read, explaining the very unfairness of restricting mortgage-interest tax relief to which Mr Osborne was no doubt referring, I feel that I can be sure (as can you) that such correspondence would also have detailed the inevitable drastic social consequences proceeding from the measure. These being of course, higher rents, evictions and untenable pressure upon the waiting lists of councils and housing charities.

That George Osborne’s response to such dire concerns, was to be inspired to dry mockery and announce yet another tax-raid upon landlords livelihoods, is just as great a reflection upon his overall character as a person, as it is towards his specific attitude towards buy-to-let landlords. Or to put it another way, it is just as much an indication of his conduct as an eventual Prime Minister than a display of his current conduct as Chancellor.

So putting aside the obvious disastrous effects of Clause 24, what will be the favourable outcomes for George Osborne and the Government of its implementation? Will it solve the disparity between the demand and supply for homes in the United Kingdom? No it will not, because this disparity is the cause of population (demand) increasing at a faster rate than the construction of new homes (supply).

Shall tenants benefit from a so-called “leveling of the playing field” between owner-occupiers and landlords, by becoming owner-occupiers themselves en-masse? No they will not, because the overwhelming majority of people who rent do so because they NEED to: they need rental accommodation because they are either, too early into their current job to be sure of their position far enough into the future, working temporarily in the UK or a particular part of the UK, or prevented by unemployment, restricted working hours, single-parenthood, illness, disability or a poor credit record from being able to buy a house. It is true that such people will be shifted out of the private rental sector by Clause 24, but not into their own houses. They will be shifted into the spare rooms of their parents, onto the sofas of their friends, and on to the waiting lists of councils and housing charities. Clause 24 cannot therefore have been designed with their welfare in mind.

Shall the measure stimulate increased tax revenue? Yes… at least for as long the rump of the buy-to-let landlords it is targeting can remain afloat. But if the motivation of Clause 24 was to generate much needed finance for government spending, why isolate it to individual buy-to-let landlords? Why not levy such further taxation upon rental incomes across the board, raiding the deeper pockets of corporate and cash buyers? After all, aren’t these parties the most able (or should I say “the least unable”) to pay? Should not those with the biggest shoulders assume the heaviest burden? In relation to personal income tax, this mantra has been parroted by Tory ministers for as long as we can remember. So why anomalously discard it when taxing rental income? Why indeed…

Shall wealthy corporate landlords/companies, with significant lobbying power and the potential to donate large sums of money to the Conservative Party, be gifted an unfair advantage and empowered to replace smaller individual landlords upon their being taxed to absolute financial ruin? YES THEY SHALL, because Clause 24 grossly and specifically inflates the tax-liability of individual landlords with buy-to-let mortgages: namely the working and middle class landlords who do not fall into the aforementioned category and who possess negligible inducements with which to buy political influence.

The social consequences of Clause 24 have been made clear to George Osborne by many landlords and by a growing minority of media commentators choosing not to bandwagon. Furthermore, owing to Mr Osborne being an individual of above-average intelligence and no less than The Chancellor of the Exchequer of Great Britain and Northern Ireland, the notion that he would not already have been aware of Clause 24’s social consequences prior to its inception is highly unlikely. Given these rather obvious circumstances one can only conclude that in the Westminster playground he inhabits, the fulfillment of vested interests are a higher priority to George Osborne than cries of upheaval and pain from the country at large: a priority high enough to warrant stabbing a substantial section of his party’s voters in the back for its preservation.

Through the Finance Bill 2015-16 we have learned of George Osborne’s willingness to heartlessly exploit an extremely ill-informed media bandwagon and to persecute landlords for his own political gain. But we have also learned that honesty, integrity, morality and public service – qualities essential to a political leader – are qualities of which the Chancellor is not in possession. In showing himself to be desensitised, backstabbing, mocking towards the suffering of people, and willing to manipulate the fiscal levers of government in preference of vested corporate interests, George Osborne has demonstrated why he must never be allowed to become Prime Minister of this country.

With that in mind, I believe it is time that we prepare to say “no” to George: I mean really say “no” to George. This means that as well as signing the online petition to reverse Clause 24 https://petition.parliament.uk/petitions/104880 every landlord should register as supporters of the Conservative Party to become eligible to vote in its eventual leadership election https://www.conservatives.com/join If we are persistent in promoting this idea to as many landlords as possible via as many channels as we can, between now and the close of David Cameron’s tenure as party leader we could have a great many people able to influence the outcome of the final ballot. Were Mr Osborne to be aware of this activity in the run-up to his leadership campaign, he may just realise the extent of this grave policy error and the very real, political cost to himself of enacting it. If however, we remain dissatisfied with Mr Osborne’s performance and decision-making, we can all vote for his rival in the contest, thereby discovering if he is even half as amusing towards losing as he was in the Autumn Statement to our warnings concerning Clause 24.

Previous Article

Shared freehold with permanently empty flat and unresponsive owner?

Gareth Wilson

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up0:49 AM, 28th February 2016, About 9 years ago

George Osborne under fire over 'steady drip' of business taxes

http://www.telegraph.co.uk/business/2016/02/26/george-osborne-under-fire-over-steady-drip-of-business-taxes/

"Carolyn Fairbairn, the head of the Confederation of British Industry (CBI), warned this month that the Chancellor’s tax assault on business had pushed the economy to a 'tipping point'."

Gareth Wilson

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up14:29 PM, 2nd March 2016, About 9 years ago

"PAY YOUR TAXES, GEORGE"

TELL THE CHANCELLOR HE SHOULD BE CLOSING TAX LOOPHOLES - NOT USING THEM HIMSELF

http://www.38degrees.org.uk/page/s/osborne-pay-your-taxes#petition

Gareth Wilson

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up11:45 AM, 13th March 2016, About 9 years ago

"George Osborne said pre-election Budget would only help 'stupid, affluent and lazy people', claims former minister

The Chancellor also reportedly said it could 'fudge' the figures a bit"

http://www.independent.co.uk/news/uk/politics/inside-story-of-david-cameron-and-nick-cleggs-coalition-government-revealed-in-memoir-a6928491.html