9:21 AM, 7th March 2023, About 2 years ago 1

Text Size

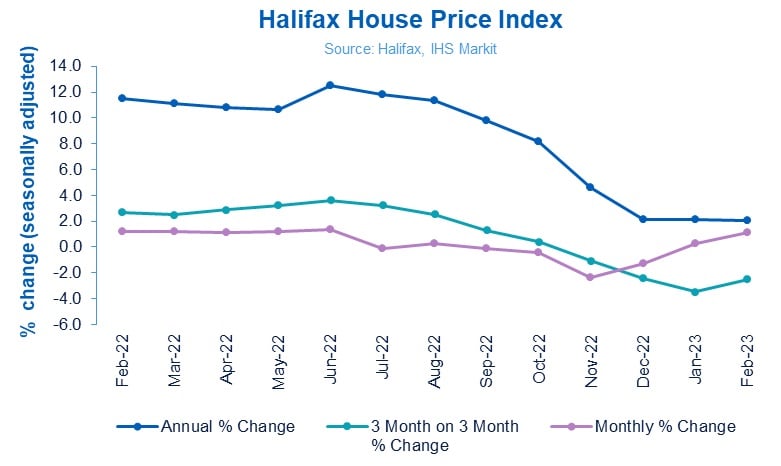

The UK’s house prices showed an unexpected increase of 1.1% in February from January’s price, says Halifax.

The bank highlights that a typical property costs £285,476 – up from January’s average price of £282,360.

However, the rate of annual price growth has slowed in all regions with an annual rise of 2.1%.

Kim Kinnaird, the director of Halifax Mortgages, said that overall prices are flat compared to three months ago and added: “Recent reductions in mortgage rates, improving consumer confidence, and a continuing resilience in the labour market are arguably helping to stabilise prices following the falls seen in November and December.

“Still, with the cost of a home down on a quarterly basis, the underlying activity continues to indicate a general downward trend.

“In cash terms, house prices are down around £8,500 (-2.9%) on the August 2022 peak but remain almost £9,000 above the average prices seen at the start of 2022 and are still above pre-pandemic levels, meaning most sellers will retain price gains made during the pandemic.

“With average house prices remaining high, housing affordability will continue to feel challenging for many buyers.”

Sarah Coles, the head of personal finance at Hargreaves Lansdown, said: “Average house prices ticked up gently in February, keeping annual rises around 2%, and raising hopes we could be heading for a soft landing.

“But there’s an awful lot stacked against the market, which could tip it into a more painful decline.”

She added: “Optimism has survived another difficult month. Buyers have seen mortgage rates drop back consistently for the past few months.

“They also have the comfort of relative strength in the employment market, and as a result, consumer confidence has recovered a little.

“So there remains a glimmer of hope that house price falls this year could remain in single digits.”

Iain Crawford, the chief executive of Alliance Fund, said: “House prices appear to have stabilised at a far quicker pace than anticipated, following the string of significant downward monthly corrections caused by the turbulence of last September’s mini-Budget.

“This suggests that the nation’s homebuyers and sellers are coming to terms with the new normal of higher interest rates and are continuing to transact at this new middle ground, having adjusted their position in the market accordingly.

“However, we’re certainly not out of the woods yet and while the current outlook is a more positive one, the wider economic landscape and the current cost of living crisis will continue to have an influence.”

Marc von Grundherr, a director of Benham and Reeves, said: “Although previous reports of housing market health have been less than positive, those of us on the ground are privy to changes in market sentiment far sooner than the reporting of top line statistics allows.

“While current house price performance may remain sluggish when compared to the meteoric rates of the pandemic market boom, there’s been a notable uptick in activity in 2023 and this has reversed the rot seen during the back end of last year.”

Previous Article

A thick fog of stupidity, jobsworths and Section 24Next Article

S21 notice/Rent arrears/repossession order?

Contendedted

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up10:59 AM, 8th March 2023, About 2 years ago

I will be testing the market this year but the only reliable guide will be supply and demand on my street. Other types of property in other towns may serve as a guide but only proceed able offers will be relevant. Likewise a trend will be more of an indication than a number for one month. I last tried in the middle of last year and got interest but no offers. Therefore I shall tweak and go again.