9:18 AM, 23rd March 2023, About 2 years ago

Text Size

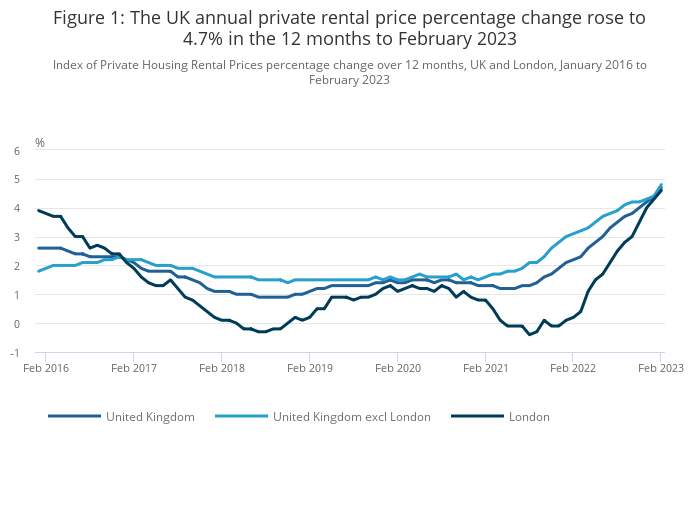

Tenants in the UK have seen their private rents rise by 4.7% in the year to February – which is still below the annual rate of inflation.

The figures from the Office for National Statistics (ONS) show that rents rose by 0.3% from January and the annual percentage change is the largest recorded by the organisation since it began keeping records in January 2016.

The annual figure is up from the 4.4% recorded in January 2023.

The data shows that rents increased by 4.5% in England, 4.2% in Wales and 4.9% in Scotland in the 12 months to February 2023.

Within England, the East Midlands saw the highest annual percentage change in private rents of 4.9%, while the West Midlands saw the lowest at 4.0%.

London’s annual percentage change in private rental prices was 4.6% in the year to February 2023.

The ONS says that rents remained steady between November 2019 and the end of 2020.

Then the annual percentage change in rents began to slow in early 2021, which was driven by the slowdown, and later reduction, of London rental prices.

The ONS report also references a survey by Propertymark that the PRS ‘remains out of balance’ as demand outweighs supply.

A report from the Royal Institution of Chartered Surveyors was also noted because it points to growing tenant demand – as landlord instructions decline.

Gareth Atkins, Foxton’s managing director of lettings, said: “Considering how 2022’s prices climbed through the latter end of the year, we did expect higher prices in Q1.

“February’s unseasonable rise in average rent price, higher than last year’s record-breaking peaks at over £570 per week, is a strong indicator of how intense the imbalance is between supply and demand in the London lettings market.”

He added: “This month, we’ve seen many more tenants choosing to extend their lease, so those properties aren’t coming back onto the market.

“At the same time, we’ve found a remarkable increase in corporate searches as businesses take the opportunity of favourable currency rates to invest in new London offices, raising demand.”

And the firm’s Sarah Tonkinson, its managing director of institutional PRS and build to rent, said: “With 20 renters registering per each new property on the market, right across London, we are in the midst of an unbelievably competitive first quarter.

“Budgets have increased in every region, and average rent has, once again, broken records.”

She continued: “However, despite the low rental supply in London, there was an interesting increase new listings in the boroughs of Westminster and Tower Hamlets.”

Previous Article

UK house prices fall between December and January