10:25 AM, 3rd March 2014, About 11 years ago

Text Size

Since publishing this article our campaign has raised over £450,000 and legal action has now commenced. The official closing date for borrowers to be represented in this action was 28th March 2014. However, it may still be possible to be included in the representative action by paying additional fees to cover administration and Court fees to be added to the list of represented claimants. For further details please Contact Carla Morris-Papps at Cotswold Barristers – telephone 01242 639 454 or email carla@cotswoldbarristers.co.uk

Borrowers representing 84 mortgage accounts affected by the West Bromwich Mortgage Company 1.9% rake hike to their tracker rate mortgage margins attended a secret meeting of paid up campaign members on 27th February 2014. At that meeting it was confirmed that 420 affected mortgages are currently represented by the campaign group.

Property118 had previously created a secure forum for paid up members of the group to discuss various legal strategies, one of which was a proposal to West Brom to consider arbitration as an alternative to Court action. Each member had paid £240 for each affected mortgage plus a contribution to a campaign marketing campaign.

Arbitration was proposed for tactical legal reasons which were explained by the groups advisers, some details of which must remain confidential for legal reasons.

This would have been significantly quicker and cheaper for all concerned and had massive upsides to West Brom in that the outcome would be confidential. In other words, if West Brom had lost the case, nobody would have “officially” known about it other than those who had already paid to be a member of the campaign group. This would have meant the worst case scenario for West Brom would be losing no more than 10% of their reported £19 million of additional annual profits from this rate hike.

West Brom refused!

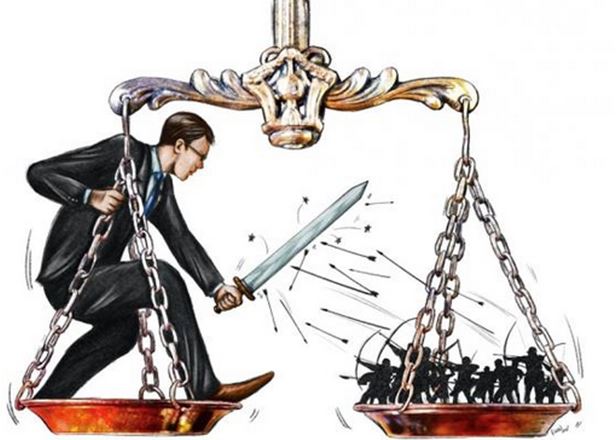

This refusal now plays very nicely into our hands for litigation purposes as it will be frowned upon by the Courts, especially if we lose our case and end up having to pay costs associated with the David and Goliath battle. 😉

The attendees of the meeting voted unanimously to proceed immediately with litigation on the basis proposed by (Mark Smith – Barrister-At-Law) as explained below. Thanks were offered to Justin Selig and his team at The Law Department for his sterling work to date in helping us get to this position. Without their help our campaign may never have got this far.

Litigation will commence during the week of 31st March 2014 with the service of Court Papers. This provides a final opportunity for any remaining affected borrowers to commit to the action by Friday 28th March.

We already have more than double the necessary funds on account to pay our own legal team. Mark Smith has agreed to represent borrowers for a fixed fee of £120 + VAT per affected mortgage subject to there being at least 250 borrowers committed. Further details in his Terms of Business and Instruction letter which can be downloaded by completing the form at the bottom of this page.

Existing campaign members are also reminded that they MUST complete and return the instruction form to Mark Smith to act for them and the required additional funds by 28th March 2014.

The deadline for submission of instructions has now expired, sorry.

The primary concern of existing members that had to be overcome was their potentially unlimited liability to the West Brom’s legal costs in the event of losing the case and the “open cheque book” often associated with legal cases. It was agreed that all fears could be overcome by creating a fund to be held in a BARCO escrow account (BARCO is the Bar Council – the regulators of Barristers). This account will provide evidence to the Courts that we have sufficient funds on account to settle the other sides costs in the event of losing the case and having an adverse costs order awarded against the group.

The first step of the legal action will be a costs hearing, as part of a “Case Management Conference”. This is where both sides must submit their costs budgets for the case to the judge and where the judge decides upon reasonableness. If either side fails to do this then the maximum they can claim for costs against the other side is the Court fee, i.e. £175! It is extremely rare for judges to award costs in excess of the agreed costs budget.

Our estimate is that based on the number of affected mortgages being represented, and the possibility of more people now wishing to be represented at this stage, the BARCO account could contain as much as double the other sides costs budget. This is why we are so confident about costs not exceeding the amount of funds that will be held in escrow. In the extremely unlikely event of the groups funds being insufficient to meet a potential costs order the group would have an opportunity to withdraw their case and settle the other sides costs to date.

If/when we win, the contents of the BARCO account will be rolled over to deal with all of the costs associated with the inevitable appeal case and if/when that is won the funds will be returned to members. If we lose, the contents of the escrow account will be used to pay costs awarded to West Brom and the balance of funds will be returned pro-rata to members.

The case will be fought on the basis of a representative action. This means that the ruling of the Courts will only apply to those borrowers who have paid to be represented in the case. There will be no free rides!

We fully appreciate that some affected borrowers will not be able to raise the necessary funds in time to be part of this action so there is a Plan B. Affected borrowers who are not represented may have another opportunity to make claims in a few years time. In the meantime they will continue to pay the higher rate and will probably be expected to forfeit any refund of overpayments in return for a no-win-no-fee arrangement. This could be a far more expensive option, hence the reason why so many affected borrowers are so keen to be part of the imminent legal action.

The legal strategy and process we are undertaking will be a very simple one. There will be no witnesses called so there will be no surprise twists such as those often seen on TV where a new witness or new evidence appears at the last minute. On this basis, we anticipate the case, including any appeal, to be concluded before Christmas.

We will only be asking the Courts to rule on two things:-

1) Based on the documentation produced by West Brom, do they have the right to increase the tracker margin?

2) Based on the documentation produced by West Brom, do they have the right to call in loans within 28 days without the borrower being in default?

There has been lots of discussion about whether West Brom did or did not provide all of the documentation they are now relying upon. This is not relevant to our case.

There has also been much discussion about Unfair Terms in Consumer Contract Regulations; again this is not relevant to our case.

It has been questioned whether in fact the mortgages issued by West Brom were indeed trackers, this cannot be denied by West Brom as this is the basis they report them to the rating standards agencies – see this link

The agreed level of funds to be deposited into the BARCO account is £1,144 per affected mortgage being represented. For example, somebody wishing to have 10 affected mortgages represented will need to deposit a further £11,440 into the BARCO account. Existing members will receive a refund of unused funds which they paid into the client account of The Law Department. New members will need to pay an additional premium of £356 per mortgage to the Property118 marketing fund to equalise the financial contributions and efforts of the forerunners of the group.

Therefore, the net payment per affected mortgage for members will be:

We have created a simple set of instructions explaining how much you need to pay and who you need to pay it to here >>> http://www.property118.com/simplified-payment-instructions-join-west-brom-action/

Remember, if/when we win you will get more than this amount back when you also factor in 100% of the extra 1.9% interest you have been paying which will also be refunded. The worst case scenario is that you will get none of this money back if we lose. If you can live with that you should proceed.

The reason we have chosen this strategy as opposed to buying ATE insurance is that it costs us much less if we win. We are in this to win this. The above strategy means that we all know what we stand to lose and can proceed with our eyes wide open, confident that our liabilities are limited.

If the balance of the BARCO account associated with this action is less than £250,000 by close of business on Friday 28th March 2014 the legal action case will be aborted, funds will be returned to members within 14 days and that will be the end of the line for this campaign for myself and Property118 – at least for 12 months or more anyway. If necessary we will then take another look at Plan B.

Since publishing this article our campaign has raised over £450,000 and legal action has now commenced. The official closing date for borrowers to be represented in this action was 28th March 2014. However, it may still be possible to be included in the representative action by paying additional fees to cover administration and Court fees to be added to the list of represented claimants. For further details please Contact Carla Morris-Papps at Cotswold Barristers – telephone 01242 639 454 or email carla@cotswoldbarristers.co.uk

Previous Article

Buyers Premium Rip-Off At Property AutionNext Article

How crucial is lift for a 2nd floor flat?

Mark Alexander - Founder of Property118

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up15:25 PM, 19th March 2014, About 11 years ago

Reply to the comment left by "ian " at "19/03/2014 - 15:12":

There have been a few but we have not reconciled them yet.

Rest assured we will be doing so to ensure that they have also paid the extra £356 per mortgage into the market pot. At the moment we are flat out answering calls, emails, texts etc. from people still making their mind up and given the deadline date that's obviously our priority at the moment.

.

Rob & Julie Atkin

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up16:49 PM, 19th March 2014, About 11 years ago

Posted our cheque for £4576.00 and instruction today for 4 x mortgages. Also sent all documentation, 4 complaint forms and covering letter to Financial Ombudsman - took most of the day to copy it all.

Ju Stacey

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up17:25 PM, 19th March 2014, About 11 years ago

Latest summary

06-Mar 32 £36,608

07-Mar 36 £41,184

10-Mar 57 £65,208

11-Mar 72 £82,368

12-Mar 97 £110,968

13-Mar 121 £138,424

14-Mar 124 £141,856

15-Mar 144 £164,736

17-Mar 157 £179,608

18-Mar 165 £188,760

19-Mar 192 £219,648

Obviously there are some in transit, but there are reports of 12 new postings today.

Mark Smith Head of Chambers Cotswold Barristers

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up17:35 PM, 19th March 2014, About 11 years ago

URGENT NOTICE

If anyone has emailed Cotswold Barristers since 2300 last night (Tuesday) please send your message again, as our server will have bounced it back as undelivered.

The fault is now rectified. Heads have rolled.

Richard Kent

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up18:14 PM, 19th March 2014, About 11 years ago

Reply to the comment left by "Ju Stacey" at "19/03/2014 - 17:25":

It's great watching the momentum of this campaign 🙂

It looks like the campaign is going to exceed the £250,000 barrier.

You have a great team with Mark Smith and Anthony Wilson.

Anthony Wilson has done a great job of instilling confidence.

Great news for you guys

Let's see if the West Bromwich have the sense to back down when the first litigation papers land on their doorstep 🙂

Ju Stacey

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up18:49 PM, 19th March 2014, About 11 years ago

I'd missed the one when Mark was on the train, so here's the correct one.

06-Mar 32 £36,608

07-Mar 36 £41,184

10-Mar 57 £65,208

11-Mar 72 £82,368

12-Mar 97 £110,968

13-Mar 121 £138,424

14-Mar 124 £141,856

15-Mar 144 £164,736

16-Mar 157 £179,608

17-Mar 165 £188,760

18-Mar 176 £201,344

19-Mar 192 £219,648

Ed Atkinson

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up22:50 PM, 19th March 2014, About 11 years ago

Well done Ju. I have plotted the data and it is shown here as my Membership image.

The upper line is progress and the lower one is the target line which rises steadily from zero on 5th March to 250 mortgages on 28th March

If you click on the image you'll see it a bit larger

Mark Alexander - Founder of Property118

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up22:59 PM, 19th March 2014, About 11 years ago

Reply to the comment left by "Ed Atkinson" at "19/03/2014 - 22:50":

FUNDS UPDATE

I love the graph Ed, great job 🙂

I have just got in from a meeting and notice that Cotswold Barristers have updated the spreadsheet again.

The funds total is now £227,656 which represents 199 affected mortgages.

.

Anthony Wilson

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up0:29 AM, 20th March 2014, About 11 years ago

Reply to the comment left by "Richard Kent " at "19/03/2014 - 18:14":

Thank you to Richard Kent for your kind comments,... it really feels very good to be part of this now.. Addleshaw Goddard would appear to be acting for the West Brom on this issue ...no doubt they are aware of this campaign and no doubt tracking its progress with alarm as we near the target.

Richard Kent

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up9:25 AM, 20th March 2014, About 11 years ago

Reply to the comment left by "Anthony Wilson" at "20/03/2014 - 00:29":

Anthony,

Your presence here has had an significant impact on increasing trust in this campaign, especially the fundraising part.

Also I have seen a lot of 'old faces' who make the occasional appearance to let you all know that they are still interested in the campaign, and some of which are not affected by this hike.

Then there's the dedicated core of supporters/activists such as Denise D etc.

Together you are drawing on and utilising your strengths.

I can't muster cheap short lived emotive speeches for this campaign as I believe the only solution is action, funding and awareness.