15:44 PM, 3rd May 2016, About 9 years ago

Text Size

Having raised over £500,000 to take West Bromwich Mortgage Company to the Court of Appeal it has been suggested by numerous Property118 members that we should become a Landlords Association.

Having raised over £500,000 to take West Bromwich Mortgage Company to the Court of Appeal it has been suggested by numerous Property118 members that we should become a Landlords Association.

Sentiment appears to be that a group with courage to take legal action against rogue mortgage lenders and poor decisions made by Government is seriously needed in the UK Private Rented Sector.

Subject to levels of interest this is something that we are willing to consider further.

Towards the bottom of this article you will find an expression of interest form. The ideas we are considering are:-

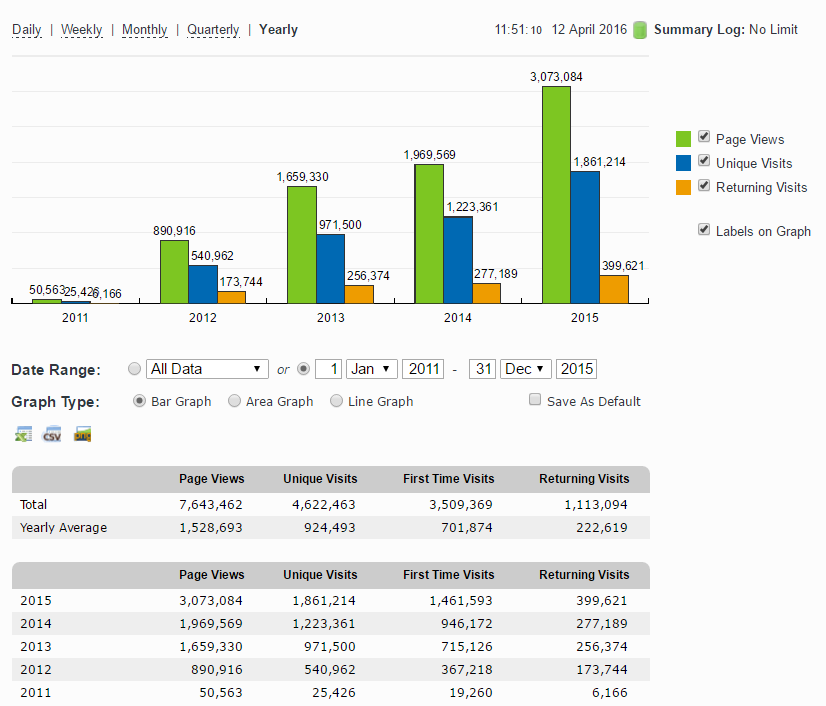

The growth of Property118 has been tremendous over the last five years as can be seen from the statistics below. This year we are projecting in excess of 5 million page views.

Property118 Growth – 1st Jan 2011 to 31st Dec 2015

Property118 Stats – 1st Jan 2016 to 10th April 2016

Whilst there is no guarantee that we will convert Property118 into a Landlords Association it is something we are seriously considering. A decision on whether to progress will be made based on the responses to this article. Here are some of our thoughts to date ….

The existing Landlord Associations have a track record of being shy of litigation.

Property118 has a track record of raising funds and seeking justice through the Judicial System. Ombudsmen and lobbying have their place but rarely achieve much more than publicity for a particular cause. If we progress this ideas and Property118 Landlords Association is launched we may not always be successful in litigation but we will pick our battles wisely and ensure that in every case the minimum outcome will be far greater awareness of any issues affecting UK landlords which to choose to tackle.

Transparency is key. We are capitalists at heart which means that we believe that success has to be rewarded; for our members, for ourselves and for those who back us financially. We have discussed the possibility of implementing a similar structure to that of Shelter and becoming a registered charity but we do not feel this would be right in terms of our core objective for transparency.

Property118 already owns 26% of the shares in LettingSupermarket.com as well as having revenue sharing agreements with many of our website sponsors. If we were to create a Landlords Association we would do so whole heartedly. In other words, all of the existing business arrangements that Property118 has (which for the avoidance of doubt doesn’t include our private property portfolios) would be incorporated into the Landlords Association.

The founders of Property118 value the goodwill of the current business at £5 million. If we were to incorporate our existing business and transform it into a Landlords Association then we would want our members to own part of it and to be as financially committed to it’s success as we are. To achieve this shares could be sold. This initial share capital would be the foundations upon which Property118 Landlords Association is built and would also provide us with confidence that we are doing the right thing.

If we decide to go ahead our first objective would be to recruit 50,000 paying members within 5 years. This would produce circa £6 million a year of revenue, i.e. £10 per month per member X 50,000 members =£500,000 per month.

To enable members to own a stake we could initially offer 1% of shares via a crowdfunding platform for £50,000. The minimum investment could be just £10. Over-funding could then be considered, e.g. if there is enough interest to raise £500,000 then 10% of the shares could be made available and so on. Whilst such a structure would decrease our personal shareholdings it would also provide funds to facilitate a more rapid growth in terms of membership recruitment.

To provide some assurance to both members and investors that we wouldn’t simply draw all profits from the business ourselves we would be prepared to commit to capping all directors emoluments to the projected 2016 earnings level of £225,000. That would be the maximum that all Directors collectively could take out of the business in terms of salary, bonuses etc. Any additional income for the Directors would then rank on par with that of the shareholders from dividends.

Property118 currently operates on a profit margin of circa 35%. Assuming this figure is maintained and assuming the membership target of 50,000 is achieved then shareholders earnings would be £2.1 million per annum. This equates to gross annual earnings per £10 share of £4.20.

Now some people may say that a 42% ROI based on an initial target of recruiting just 50,000 members from a pool of what is said to be around two million landlords just isn’t right and that the returns are too high. Well that’s capitalism folks. Once this target is achieved the value per share will not be £10 either!

Some will ask, what if Property118 doesn’t grow and what if Mark Alexander were to die, so I will address those points now. I post less than 2% of all comments and articles on Property118, the rest are posted by our members. On that basis, why should Property118 stop growing, are landlords likely to face no challenges in the future? Nobody is irreplaceable or has a monopoly on good ideas. Nothing that has been achieved by Property118 has been achieved by one person alone. It has been the vision and engagement of a growing community of landlords that has brought us to this point. The question for us all now is this; where should we take it from here?

Membership growth is projected to be achieved organically, as has been the case for page views to date. This is because existing members share their interactions with Property118 and their positive experiences with other landlords. Momentum is continuing to accelerate, as can be seen from the stats, and we have every reason to believe this will gain further pace once we have proper funding and infrastructure to campaign and appeal against other injustices against landlords and back our challenges with legal action as neccessary and commercially viable. Furthermore, a broad, growing and solid financial and membership base combined with increasing revenue streams will provide additional opportunities to fund increased PR and brand awareness campaigns. Given that there are believed to be around 2 million landlords in the UK we would like to think the initial objectives we are considering should be realistic. What do you think?

Existing monetisation projects will continue unchanged, save for the fact that all income and profits will accrue to the new company.

We would also apply for EIS relief on shares. This has significant tax benefits – details here >>> https://www.gov.uk/government/publications/the-enterprise-investment-scheme-introduction

I am interested in the following ....

At last – a #landlords‘ union!! EXACTLY what we need! https://t.co/qr7Uvqpyft @IamALandlord @jamesalexandere

— Mandy Thomson (@lodgersite) May 4, 2016

Previous Article

Agent or Solicitor negligence missing stamp duty deadline?

Mark Shine

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up12:47 PM, 7th May 2016, About 9 years ago

Reply to the comment left by "David Price" at "07/05/2016 - 11:48":

Yes David, completely agree with you there. I also expect most LLs would find it hard to disagree from a moral perspective, even if S24 offers business expansion opportunities for some.

Mick Roberts

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up17:33 PM, 8th May 2016, About 9 years ago

Brilliant idea. Seems like there could be a lot of big clout & opposition to some stupid Govt decisions.

Mark Shine

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up21:25 PM, 8th May 2016, About 9 years ago

Sorry all, I sincerely don’t mean to derail this thread, and would support any attempt that would create a new effective association or help the existing associations to be more effective, but Jamie and Robert: I am still a little surprised by your apparent ‘surprise’ to what I wrote a day or two ago.

One of the only two avenues that the lawyers are challenging and seeking the JR, is that Clause 24 (now Section 24) IS a grant of state aid to corporate landlords.

Big Blue

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up22:09 PM, 8th May 2016, About 9 years ago

Reply to the comment left by "Mark Shine" at "08/05/2016 - 21:25":

To be honest Mark, having re-read your posts several times, Im not entirely sure what point you are making. Are you saying that unencumbered/corporate landlords are ok with S24 because they can claim higher rents without being affected? I know many that aren't ok with it. Plus, encumbered non-corporates can put rents up too to try to survive, as I have and will have to.

As to associations working together, the realistic shame is that it will not happen. Politics, self-interest, different philosophies - they absolutely won't do it. The two biggest ones despise each other, plus of course they don't agree with 118's/the JR's method.

Don't get me wrong, I truly wish they would all work together and a big new 'super association' would be great but I doubt it will happen.

And the JR is being fought on three grounds, not two.

Robert M

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up22:09 PM, 8th May 2016, About 9 years ago

Reply to the comment left by "Mark Shine" at "08/05/2016 - 21:25":

Hi Mark

Not so much surprise, just wondered what you were getting at, as the earlier comments were a bit vague. However, now you have clarified:

1. Increased demand for THEIR rental properties if supply decreases because encumbered LLs forced to exit the market.

2. ‘Distressed’ sales / buying opportunities for them as some of the encumbered or non incorporated LLs sell up. In the current climate, FTBs are perhaps unlikely to buy all the HMOs that may come to market?

In relation to your "Increased demand" argument, I can see that there may be some landlords who go bankrupt, or decide to sell up, because of the extra tax burden, but generally speaking, I think it is just far more likely that rents will increase to cover the additional tax burden, hence why it is a "Tenant Tax". It will bring hardship to tenants, and many tenants who find that they cannot afford to rent a property may have to consider moving to cheaper areas or doing a house share with other people. (But this is already happening for DSS/LHA claimants anyway due to the Benefit Cap). I do agree that the Tenant Tax may potentially give unencumbered landlords an advantage, as they could charge less for their properties if they wished, but this is already the situation for unencumbered landlords, so how will clause 24 change this already existing advantage?

In relation to the "distressed sales" argument, there are already lots of distressed sellers out there, so anyone with money can buy a property at below market value. However, other buyers (e.g. those buying to live in themselves, not just first time buyers) will have the same buying opportunities, and although they may not be buying HMOs to rent out, they may buy HMOs to convert back into family homes.

Landlords (incorporated or otherwise) with cash instead of needing mortgage finance, have always been at an advantage when it comes to buying properties, and also have more opportunity to profit from their investments, so this disparity will remain whether the Tenant Tax comes in or is defeated. The only difference the Tenant Tax will make overall, is to push up the rents that tenants have to pay, push up the national Housing Benefit bill, and make a lot of people homeless (which will cost the Government even more to deal with, as there are knock on effects to other sections of society as well, e.g. police, health services, etc).

The sooner we have a landlord's association that is not scared to raise these points and demonstrate the knock on effects to Government, and challenge them on the legality (and fairness) of their actions, the better.

Mark Shine

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up23:18 PM, 8th May 2016, About 9 years ago

Jamie: YES, that was the point I was making. And always have I think. Although I do apologize if I was recently a little unclear. I totally sympathize with FTBs and other OO’s due to ridiculous house prices in high demand areas, including in the PRS-free area where I live, but to primarily target only one section of LLs (the minority who use finance and are not incorporated), whilst the majority, including our HPC voyeurs or rather their own token LLs who all critique every post here, will actually BENEFIT from S24 at the expense of tenants, renders HMT’s and their media pals’ propaganda as highly questionable. Sorry for repeatedly labouring the same point.

Robert: I have never particularly liked the term ‘Tenant Tax’, but nevertheless I have always maintained that clearly S24 is likely to encourage above inflation upward pressure on rents. In response to your question how will it ‘change this already existing advantage’: simply more (MOAR) for them, including GO’s LL buddies and HPC’s very own pet LLs.

Robert M

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up0:00 AM, 9th May 2016, About 9 years ago

Reply to the comment left by "Mark Shine" at "08/05/2016 - 23:18":

Hi Mark

I think you are speaking a different language to me, - I don't know what HPC voyeurs are? or HMTs and their media pals? or MOAR? and I don't know who the "token landlords" are?

As far as I can see, Landlords across the country are being hit with a tax on their turnover rather than just on their profit, and this will inevitably force rents up to cover these additional costs. As it is a TAX, that forces up the landlord's operating costs, then tenants will have to pay more or the landlords (with mortgages) may go bankrupt, so the rent will have to go up to cover this extra tax burden. As a tax that forces tenants to pay a higher rent, the term "Tenant Tax" is in fact very accurate.

Mark Shine

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up1:10 AM, 9th May 2016, About 9 years ago

Hi Robert

HPC = I imagine Mark A would not be too happy for me to give their full web address here, but they are the characters who:

- Are GO’s main supporters for Section 24.

- Are the same handful of hardcore keyboard warriors who appear in the every comments sections after every housing related online media news article spouting utter gibberish.

- Instructed all their members to give a thumbs down to https://www.youtube.com/watch?v=ZZImjp3xw58 in the last 48 hours

- Were the people who instructed their members to all award 5 stars to http://pdpla.com/index.php?option=com_k2&view=item&id=146:property-118-petition-against-the-budget-changes&Itemid=285

- ‘Work’ around the clock getting up to all sorts manipulative antics on the web and twitter.

MOAR = The term the above gang use for LL greed, which in their simplistic world only applies to LLs who are not incorporated and who also use finance. According to them all other LLs are OK.

HMT = https://www.gov.uk/government/organisations/hm-treasury

Appalled Landlord

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up12:16 PM, 9th May 2016, About 9 years ago

Reply to the comment left by "Mark Shine" at "09/05/2016 - 01:10":

Hi Mark

The comment from Portsmouth and District Private Landlords Association (PDPLA) of July 2015 to which the HPC brigade gave almost 5 stars contains the authoritative-looking statement “in Europe where the UK is the only country to allow finance charges to be claimed against tax”. This was the opposite of the truth.

The previous month, Kath Scanlon and Christine Whitehead of the London School of Economics had reported the true position. On page 17 of their report, commenting on the Green Party’s manifesto proposal for the removal of the mortgage interest deduction for private landlords, they stated:

“Britain is not unusual in its tax treatment of mortgage interest—in fact across Europe landlords can deduct these payments from taxable income, Finland being the only exception (Scanlon & Kochan 2011).” Their table on the next page shows 10 advanced European countries which allow full deduction.

http://www.landlords.org.uk/sites/default/files/NLA%20Final%20Interim%20Report.pdf

The moral is that you can’t always trust what seems to be an authoritative statement from the PDPLA – it might be a blatant lie.

The LSE report went on to show how the tax situation is less favourable to landlords in the UK than in other countries:

“But in most countries, other elements of the tax code are more favourable to landlords. In particular, many countries permit landlords to depreciate their rental investments (either the entire value or the cost of the building only).”

“Similarly, many countries permit so-called ‘negative gearing’, where landlords can offset losses from residential rental properties against income from other sources. Again, this is not a feature of the UK system.”

“Finally, some countries have lower taxes on rental income than on other business income.”

The report also stated that UK private landlords receive no special subsidies.

This report did not consider Capital Gains Tax. A detailed comparison of both income tax and CGT with other countries is shown at: http://www.property118.com/increase-housing-supply-tax-regime-comparisons-for-landlords/83569/

Mark Alexander - Founder of Property118

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up12:36 PM, 9th May 2016, About 9 years ago

Reply to the comment left by "Appalled Landlord" at "09/05/2016 - 12:16":

Very good points, thank you.

.