19:34 PM, 27th September 2016, About 8 years ago 2

Text Size

We have released a “No Nonsense Guide To Landlord Tax” which consolidates many of the discussions and strategies shared on Property118 since the Summer 2015 Budget – details HERE

Bank of Ireland legal action strategy – NO-WIN-NO-FEE – details HERE – We have had 32 “expression of interest forms completed”. Not everybody who has taken this step has become a member yet though. It is still early days and we are waiting to receive information from compensation claimants before the first case can commence.

Skipton Building Society legal action – (includes Amber Homeloans borrowers). For details of our NO-WIN-NO-FEE strategy please CLICK HERE . We need a minimum of 240 people to sign up before we can commence action, so far we have 25. We are highly reliant on those who have already signed up to find more affected borrowers. Hopefully we will find more at The Property Investors Show at ExCel on 8th October (see below)

SAVE THE DATE – 8th October 2016 – details of our massive publicity stunt HERE

![]()

Section 24 Judicial Review – the #TenantTax coalition has produced a PDF for members to discuss with MP’s, Local Councillors and media contacts. Download it HERE

Private Criminal Prosecutions – CLICK HERE for our latest update

Sublet Insurance launched – please CLICK HERE for details

Income Tax on Capital Gains – campaign objectives accomplished. CLICK HERE for details.

Please share these updates on Facebook and Twitter.

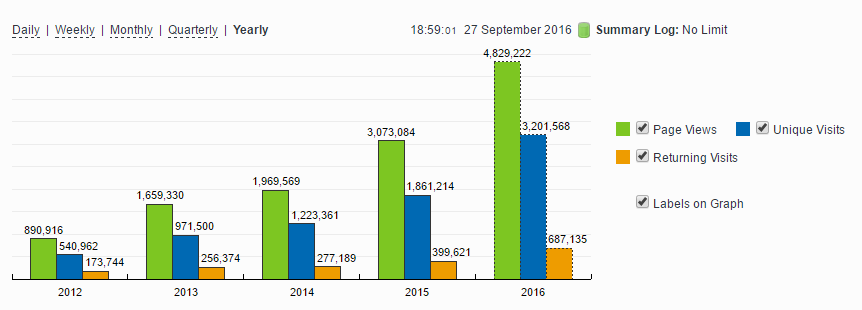

The chart below plots the growth of the Property118.com website readership. Please bear in mind that we have around three months left this year.

Thank you to The Telegraph for this article …

.

.

[strategicCTA]

Our vision is crystal clear, as are the steps we need to take, but we need YOUR help.

If just a few hundred landlords can take on the might of a rogue financial institution (and WIN!), just imagine what thousands of us can achieve!

When Property118 Action group took on the legal campaign to challenge the actions of West Bromwich Mortgage Company there were obviously doubters who said we would never raise the £500,000 required to go to Court, and even if we did we would lose. We proved them wrong!

The Financial Ombudsman Service had previously ruled in favour of the mortgage lender!

Property118 Action Group has committed to pledge £100 to the “Axe The #TenantTax” campaign for every Lifetime Founder Member.

The #TenantTax is arguably the greatest threat to the private rented sector due many landlords considering selling up. Any reduction in supply of quality rental property will negatively impact letting agents and well as increasing demand amongst tenants, thus driving up rents.

In addition to providing funding towards the intended Judicial Review of #TenantTax Property118 Action Group has undertaken significant research and lobbying as well as using our official Google News Publisher website status to promote the cause. The Property118 website attracts more than 1.8 million unique users a year and is considered to be a centre of influence amongst mainstream and regional media groups.

There are many examples of landlords having been victims of fraud by abuse of position committed by their letting agent where Police and CPS have dropped cases due to lack of resource.

We have several cases ongoing where agents have used client money to pay themselves huge bonuses before putting their businesses into administration. As a result of the Police failing to get involved Property118 Action Group has been helping to raise the funding necessary to mount private criminal prosecutions on behalf of our members. Many of these are now coming to trial.

Property118 Action Group pay all initial costs associated with private criminal prosecutions where groups of 15 or more of our members have been victims of crimes perpetrated by the same business. The Crown picks up legal costs once Magistrates agree that a trial is in the interests of the public, regardless of whether the accused is found innocent or guilty.

In March 2013 Bank of Ireland raised tracker rate mortgage margins. Over 13,000 borrowers were affected. Many of these originally took mortgages with Bristol & West which was taken over by Bank of Ireland. Two Barristers and one QC provided written opinion that they believed the Bank were in breach of contract. Sadly, Property118 Action Group didn’t exist then. Many of the affected borrowers initially expressed an interest in legal action. However, when it came to having to commit substantial sums of money to fund legal action their enthusiasm quickly dissipated leaving less than a few dozen of the more militant campaigners with the impossible task of raising the required funds. If each of those affected had only needed to commit to paying a one of fee of £600 or committing to a monthly subscription of £10 a month the position might have been very different, as would the level of media attention on the case as it progressed through the judicial system. Many of the affected borrowers have already overpaid 10’s of thousands of pounds. The Financial Services Ombudsman ruled the bank was within its rights to make the changes. However, following the Court of Appeal overruling the FOS decision in respect of the West Bromwich Mortgage Company rate hike, Property118 Action Group plans to take further legal action on behalf of its member in August 2016. All Founder/Lifetime Members with mortgages affected by this lender will be invited to be part of this legal action at no extra cost.

In 2010 Skipton Building Society unilaterally decided to abandon a contractual commitment to cap their standard variable mortgage rates to 3% over the bank of England base rate. An estimated 135,000 mortgages were affected, many of which had been provided via their subsidiary company Amber Homeloans. The Financial Services Ombudsman ruled the lender was within its rights to make the changes. However, following the Court of Appeal overruling the FOS decision in respect of the West Bromwich Mortgage Company rate hike, Property118 Action Group plans to take further legal action on behalf of its member in August 2016. Again we have the legal opinion of two barristers, both of which have advised that the lender is in breach of contract and that a Court is likely to award a full refund of all payments over and above what the mortgage contract allowed for. All Founder/Lifetime Members with mortgages affected by this lender will be invited to be part of this legal action at no extra cost.

Property118 Action Group is not insurance based, it is more akin to a Union which utilises member subscriptions to protect and fight for the rights of its members. It does not provide legal services but will procure them where necessary.

Property118 Action Group is not insurance based, it is more akin to a Union which utilises member subscriptions to protect and fight for the rights of its members. It does not provide legal services but will procure them where necessary.

Successes in the Courtroom enhance our public profile and drive an increasing number of landlords to seek the security and peace of mind that only Property118 Action Group membership can provide.

As many landlords have learned to their peril; when it comes to funding litigation against mortgage lenders or the Government, legal fees insurance policies often prove to be about as useful as a chocolate fire guard. Furthermore, trade bodies rarely have the necessary experience, resolve, finances or other resources to get involved in action beyond referring their members to their preferred suppliers of legal services, the authorities or Ombudsmen.

The UK private rented sector is often described as one of the UK’s remaining “cottage industries”.

Private landlords own around 4.8 million properties providing housing for around 22% of the adult population.

There are thought to be around two million private housing providers (buy-to-let landlords) in the UK

Private housing providers (buy-to-let landlords) often lack the experience and finances to defend their rights. Membership of Property118 Action Group provides a unique and powerful umbrella at a very reasonable price.

Letting Agents are highly reliant upon a healthy private rented sector.

Successfully defending our members’ rights continues to enhance our public profile through media based PR and reporting.

ARLA (Association of Residential Letting Agents) were the first to agree to promote Property118 Action Group at their landlord exhibitions, by having roll up banners on their own exhibition stand, handing out leaflets to attendees and signing up new members. From time to time we look for volunteers from our membership to represent us at events. Obviously we cover their reasonable expenses for this.

Naturally, we encourage our members to share the advantages of being a member of Property118 Action Group through social media, talking to friends, email and so forth.

We continue to form strategic alliances with many more organisations representing large numbers of landlords or letting agents.

We have produced leaflets, logo’s, website widgets, and roll-up banners for use in offices, shops and exhibitions. These, along with other support in terms of copy-writing, Press Releases and joint PR are all available free of charge to any organisation that wishes to form a Strategic Alliance.

If you work with such an organisation please see this link

Previous Article

Legal responsibility - N Power or Landlord?Next Article

Clause 24 response from Tim Loughton MP

john jones

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up14:38 PM, 3rd May 2017, About 8 years ago

What is the best way to sell my portfolio of 9 houses all with long term tenants residing (including my own 5 bedroom 3 bathroom detached home), where would I go for the best price. They are all in THE WF9 area of Pontefract West Yorkshire. Can someone please point me in the right direction

Black Panther

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up16:29 PM, 27th November 2017, About 7 years ago

Update BoI - Press Interest

To all of us who are still affected by the Bank of Ireland's 'differential' clause..... keep an eye out for the Telegraph this week, who will be publishing an article about this on-going situation.

See Facebook: mollystone516 re. FINANCIAL RAPE by Bank of Ireland

and Twitter: @mollystone516

"FINANCIALLY 'Weinstein'd' by the Bank of Ireland"