18:41 PM, 18th August 2017, About 8 years ago 23

Text Size

I have been asked by the founder of PropertyData.co.uk to review his latest online software for property people.

I think he deserves more than just my opinion though, so I have promised him that I will ask thousands of landlords to review it – you are one of them, I hope you will help.

Please take a look via the link below …

My first impression was that the software must have cost a fortune to develop and had institutional backing. Apparently not though. Its designer, a chap called Michael Dent, is a life-long software developer and created this software in his own spare time – IMPRESSIVE!

This is what he says about it …….

For years, institutional landlords have used data analysis of the property market to fine-tune their property investment decision-making to maximise profit.

There are now tools available for smaller landlords to make property investment decisions backed by real-time market data, boosting your property returns for a fraction of the money that the big landlords spend.

Here are six ways you can use PropertyData throughout the property investing lifecycle:

1. Pinpoint rental yield hotspots

Rental yield is a key metric for an investment property, and good yield data has historically been hard to come by. PropertyData tracks the top rental yield hotspots in the UK in real-time, with several local areas currently capable of achieving rental yields of over 10%.

2. Analyse the local market

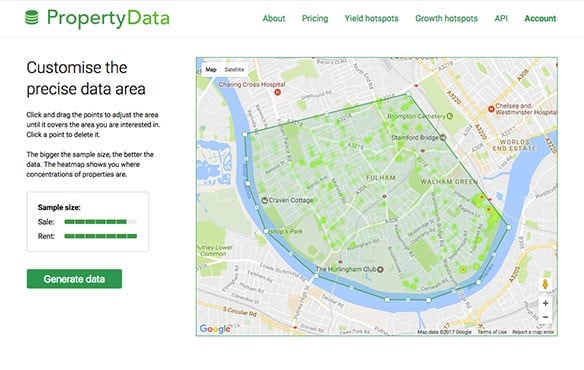

It’s surely true that there’s no replacement for property local knowledge, but PropertyData can help you understand any urban area in the UK from a quantitative perspective. You can define a custom area and then see real-time house prices and rental yields, along with historical capital growth, market composition and local demographic information.

3. Comparables analysis

Many landlords will recognise the experience of sifting through Rightmove or Zoopla to identify comparable properties for valuations. PropertyData makes this easier and faster – jump from local area analytics into individual property fact sheets to fgure out whether a property is fairly priced.

4. Compare areas side-by-side

You can save mulitple areas side-by-side in PropertyData to compare key property market statistics, such as rental yields, average prices and 3-year historical capital growth. As well as reviewing possible investment areas, this tool is great for monitoring how your existing investments are faring.

5. Find investment properties fast

PropertyData’s property finder is the easiest and faster way to find investment property, returning instantly available investment properties that match your budget, location and size criteria, looking only in the areas offering the strongest rental yields.

6. Rent benchmarking

For your current properties, maximising your return-of-investment means ensuring you are charging and appropriate and competitive rent to minimise void periods and make the best monthly return. PropertyData analyses the local rental market dynamics, benchmarking your property against similar properties locally.

PropertyData subscriptions start at £6/month with a 14-day free trial.

Find out more at

REVIEWS

Please, please, PLEASE post your review of this software in the comments below and share this article if you think this software could prove useful for other property people.

Michael will be signed up to receive comment notifications so he will be reading what you have to say and available to answer any questions you may have. Please feel free to add constructive suggestions too, I’d really like to help this guy out. This is NOT a sponsored article, Michael is just a regular business member.

Previous Article

HMRC refunds £127m on Stamp Duty surchargeNext Article

Patrick Collinson "Guardian of Housing Ignorance"

paul thomason

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up15:46 PM, 19th August 2017, About 8 years ago

intresting but i find by refurbishing my own propertys i get a 25 percent yield

Mark Alexander - Founder of Property118

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up20:38 PM, 19th August 2017, About 8 years ago

Reply to the comment left by paul thomason at 19/08/2017 - 15:46

Is that yield on capital invested net of tax or gross yield?

Giri Fox

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up20:42 PM, 20th August 2017, About 8 years ago

I had a quick look and really liked the site. Easy to find properties based on return, which is otherwise hard to do and manual. Map search is elegant too.

Elisabeth Beckett

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up9:15 AM, 21st August 2017, About 8 years ago

Although easy to use I think the data is misconstruing the situation because there are many properties in the area that I searched that are HMO's and rented by the room by spare room and gumtree. It didn't show ANY 3 or 4 bedroomed properties as it appears to miss this information completely and of course the rental on an HMO, from my experience, is much higher per property. I would suggest if you look at somewhere like Cambridge also where 6 bed HMO's renting at £500-750pm per room, a novice newby would never realise these were possible so the data should really analyse the spareroom type data too on rooms to rent. Hope this is hopeful suggestion. My 2 bedroom one bathroom properties in Bristol were converted to 3 and 4 bed with at least two showrooms, the rental in that area is showing as around £200pw, mine are double that.

Sam Addison

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up10:09 AM, 21st August 2017, About 8 years ago

I like it. While not in the market for more properties just now I can see it is a useful tool in ones armoury. I particularly like the demographics so that you can see at a glance the high returns in armouries, Leeds are because it is mainly a student area. This is obviously accessible somewhere on t'internet but I haven't come across it. I also like that it does not give misleading statistics if there is not enough data. Of course it is not the whole story but it is a starting point for further research. The price seems about right as well. I will speak to my other director about signing up.

Michael Dent

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up12:23 PM, 21st August 2017, About 8 years ago

Thank you everyone for all the comments! To Elisabeth - a very useful comment re: HMOs. At the moment the rental data and yield data covers either traditional long let (ASTs), or short lets for whole properties via AirBnb. What we do not cover are individual room letting via SpareRoom (or similar) in the HMO context. You are not the first to mention this and it is very much on the list to be added in the next couple of months. I welcome any and all other feedback!

Mark Alexander - Founder of Property118

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up15:52 PM, 21st August 2017, About 8 years ago

Hi Michael

I suggest you add an Avatar to your Property118 member profile.

Mark Alexander - Founder of Property118

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up16:05 PM, 21st August 2017, About 8 years ago

Avatar now showing Michael, that was quick!

Richard U

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up10:26 AM, 23rd August 2017, About 7 years ago

Also liked the site - particularly liked to be able to see price growth at a more granular level than other sites

paul thomason

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up13:39 PM, 26th August 2017, About 7 years ago

Reply to the comment left by Mark Alexander at 19/08/2017 - 20:38

gross rent i can explain what i am doing if you want