15:09 PM, 17th December 2018, About 6 years ago 1

Text Size

The results of Belvoir’s Q3 rental index, compiled by TV property expert Kate Faulkner, confirm that landlords are continuing to exit the property market, although not at the rate anticipated by previous research. Eviction rates remained very low, and rents showed a slight decrease, but franchisees are predicting rental rises in 2019. Franchisees are reporting that BTL remains a good medium to long-term investment in most areas, provided buyers do their research prior to purchase.

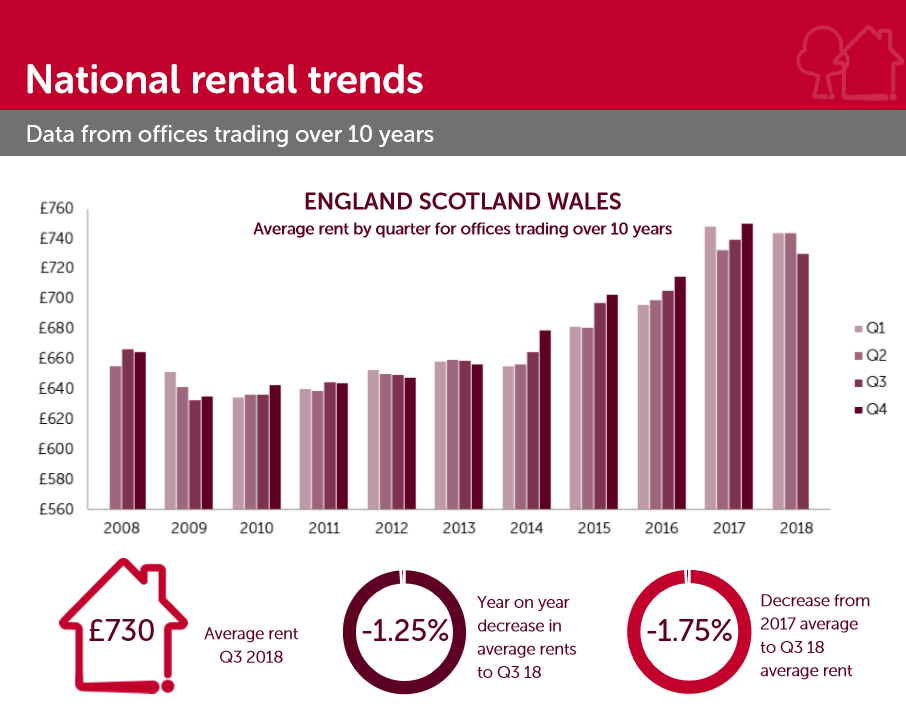

Speaking of the results of the rental index, which is published in full on the Belvoir website, (www.belvoir.co.uk), CEO Dorian Gonsalves says: “The Belvoir rental index, which is now in its 10th year, produced some interesting results. Earlier this year I forecast that rents would remain pretty flat throughout 2018 and the Q3 rental index confirms this with a slight decrease in rent of -1.25% year-on-year versus Q3 2017, and a monthly rental average of £730. This decrease seems to be due to a combination of lower rents/rises for larger properties, which traditionally have driven average rents upwards.

“There was no real change in void periods during Q3, suggesting a relatively healthy demand/supply for rental properties. Eviction rates remain extremely low, with over 50% of Belvoir offices carrying out zero evictions in Q3. The number of offices evicting four or more tenants is on the rise, but key reasons cited are non-payment of rent or landlords selling their properties, which cannot be legislated against.

“Our research shows that tenants tend to stay in their rental accommodation for the length of time that suits them. At the start of the index in 2008, most offices reported that the majority of people stayed for 13-18 months. This year we have, until this latest quarter, seen an increase in those renting for 19-24 months, suggesting two-year tenancy agreements are probably more likely to be what tenants would prefer, rather than the three-year agreements that were being discussed by policy makers earlier this year.

“Statistics show a slight increase of 48% to 52% of landlords selling up to three properties and a similar number of landlords selling between four to five properties compared to Q2. There was a decrease from 17% to 12% for landlords selling 6 to 10 properties. Two years ago 10-18% of offices were reporting no sales of landlord properties, but this figure has now fallen to 4-5%. Overall, our conclusion is that the number of landlords selling properties is increasing, albeit not at the rate that some research has suggested.

“The main reasons for landlords exiting the market are tax changes, constant regulation and increasing legislation, landlords moving back in, and lower investment returns, as well as uncertainty over Brexit, and what this will mean for the market. When selling properties, only 19% of offices reported properties being sold to first time buyers as the government hoped, however, according to our survey, 33% of offices reported properties are being sold to other landlords and 23% are general sales. This suggests the government’s plan to increase home ownership by reducing the attractiveness of Buy to Let isn’t necessarily working.

“We are still seeing landlords buying, but the numbers of properties are reduced, particularly those landlords buying six or more properties. According to HMRC statistics residential transactions were 8% lower in Q3 2018 when compared to Q3 2017. In the past we have found that when people decide not to commit to property purchases, the demand for rental properties increases, which will typically lead to higher rents and higher yields for landlords.

“It is clear from our rental index that not everywhere in the UK represents good value from an investment point of view and it is therefore worthwhile speaking to a local specialist such as a Belvoir office, who know exactly which properties are in demand, and which properties are likely to have lengthier void periods.

“Whilst landlords are operating in an environment that is slightly more expensive and more tightly regulated, with over ten million renters in the UK we predict that property will remain the tenure of choice for many millions of people in the UK for a very long time.”

Looking ahead to 2019, Belvoir predicts that property will remain a good long-term investment for the following reasons:

1) In a market with falling residential property transactions more people are likely to rent.

2) Property values are still low in many areas and rental income is likely to increase in 2019.

3) Rental yields remain good, ranging from 4.5 to 12% in some areas.

4) Good quality rental properties are still in high demand.

5) BTL remains a good, solid long-term investment.

6) Interest rates remain low, allowing investors to lock in low-cost financing, helping to support a stable long-term investment.

6) Mortgage free cash buyers are able to pick up some fantastic investment properties, including HMOs with higher yields.

Previous Article

Deposit disputes in Northern Ireland under 1%

Michael Barnes

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up16:01 PM, 18th December 2018, About 6 years ago

Someone else missing the point about 3-year tenancy proposals.

It is not that tenant is tied in for 3 years; it is that well-behaved tenants have security of tenure for 3 years, but can get out earlier if they want.