by Andy Graham

15:44 PM, 18th October 2017, About 7 years ago

Text Size

Purpose Built Student Accommodation (PBSA) is nothing new to student property owners or any student letting agent in Sheffield. But nobody can ignore it. The tuition fee hikes, tougher graduate job competition and Brexit have all changed the landscape and demographic of higher education in the last five years or so. Tighter restrictions around BTL student property investment now makes it even harder for the private sector to accommodate the vast demand for student accommodation not supplied by the educational institutions. And this is where PBSA comes in.

Why is everybody talking about PBSA?

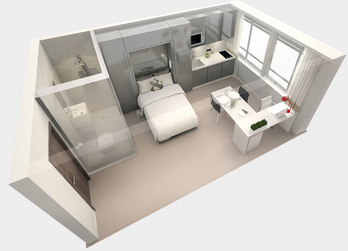

PBSA has seen growth in popularity from investors, students and seemingly also Sheffield City Council in recent years. For students, PBSA can offer an attractive solution to otherwise ‘slumming it’ for three or four years in sub-standard student properties. There is an assumption that purpose built student accommodation in Sheffield only appeals to the ‘luxury student’ who can afford to rent a room at £200 a week because they want amenities like a gym, a cinema room and fibre optic broadband. But it’s not entirely correct. PBSA prices start at around £125 a week in Sheffield and some don’t include a parking space. Generally speaking, PBSA blocks do benefit from having around the clock security, have all utilities included in one handy monthly fee and offer parents peace of mind. On another note, we’re not just talking about UK parents, but also parents of international students. This demographic of parents are more willing to pay the even more expensive tuition fees for a UK education and take comfort in the knowledge that their children are in safe and serviced accommodation.

Who is buying PBSA Units?

The recent Student Housing Report by Savills suggests investment in PBSA is coming from Foreign investors, particularly from Canada and Singapore, claiming 64% of the PBSA market, up from 35% in 2014. Why is that? Anyone would have thought that the uncertainty around Brexit and the snap election would have put off foreign investors, but the opposite is true. The number of UK students has fallen by 5% (and 7% from EU) due, in part, to higher fee hikes – students continue to return in equal numbers every year. From an investor point of view, Brexit left Sterling at an attractive buy-in level for foreign investors to snap up deals, whilst the industry and sector itself is considered secure in that it is countercyclical with a healthy 2.7% rental growth.

The report goes further to claim that 2017 will see 75,000 beds worth £5.3bn traded, up from 68,000 beds worth £4.5bn the year before. The demand is certainly there and the sector as a whole is worth a staggering £46bn. It seems the figures support the argument that student accommodation in Sheffield is set for a progressive decade. Every student letting agent in Sheffield will have to adapt and landlords should be prepared for a shift in the way they approach student management in Sheffield.

How will it affect Sheffield?

There’s no denying that Sheffield’s student population of close to 60,000 (48,000 of which are full-time, live-in students in the University of Sheffield and Sheffield Hallam), make the seven hill city a popular choice for PBSA. The universities are more than happy with PBSA and can either sell tuition to more students or not spend capital in constructing accommodation themselves. The City Council too are in favour of PBSA to supply the emerging increase in international students, but they’ll be less keen should saturation occur and some PBSA blocks fall dormant. Indeed, as previously mentioned, international students currently make up 16.9% of all students (that number is set to rise too) and contribute £187.2m to the Sheffield economy (same as above). Conservative estimates from Sheffield City Council’s PBSA Guide suggest that there are at least 16,500 purpose built beds within the city, accommodating roughly 28%. And the Council has been listening and approving plans left, right and City Centre. Developers – South Grove, Unite Students, Locate Developments, McAleer & Rushe’s and Watkins Jones Group have all had complexes approved.

Should Sheffield’s landlords be worried?

Yes and no. Institutional investors who are able to throw money at Sheffield’s PBSA market and disrupt competition with other providers are likely to drive standards up across the entire student property sector in Sheffield. The face of HMO property management in Sheffield will also change forever as student letting agents begin to favour the big accommodation contracts. But with so much new student accommodation in Sheffield coming aboard, it could push private landlords room prices down.

So should landlords sell up shop and invest in PBSA? I don’t think so. If there is one thing I am confident of in Sheffield’s student lets market, it is that students like to live where other students live. There is still a novelty associated with choosing their first house and the student community spirit is as strong as ever – you only need to go to the pub quiz @Closed Shop in Crookesmoore one evening to see a convincing example of this. The majority of PBSA developments are located near the city centre and this is not most peoples first choice of student accommodation in Sheffield.

What can landlords So?

Whilst student numbers seem to have settled down after tuition fee hikes of 2013, BTL and HMO specifically, still offer the most flexible and versatile residential investment models in Sheffield. PBSA blocks are likely to continue competing amongst themselves, primarily for the international and postgraduate market. Every aspect of student property management in Sheffield will require an emphasis to be placed on value for money, and landlords can reduce their risk by increasing the standard of their property with better furniture and funky designs (see our HMO design ideas), by switching to ‘all-inclusive’ rent packages and by placing a stronger emphasis on better property management and customer service, which according to Savills, students value higher than ever before.

Andy is the managing director of Smart Property. Smart Property provide comprehensive property management services, block management, investment opportunities and also offer a long-term rent guarantee service that Property 118 founder Mark Alexander found ‘so impressive’ he decided to invest in the company himself. Sheffield | Leicester | Manchester | Salford.

Andy is the Managing Director of Smart Property

Previous Article

Is there any recourse against the court?