10:41 AM, 6th November 2017, About 7 years ago

Text Size

The issues surrounding the buy to let market.

Some months ago I attended The National Landlord investment Show, on the issues surrounding the buy to let market and I am now returning to discuss the issues that still affect the market and to what degree the tax changes have made to the market and those operating in it on Tuesday 7thNovember at London Olympia.

The Buy to let market is undergoing some significant transformation. Last time I spoke, people were worried that in a bid to strengthen the position of first-time buyers, the government has taken a number of measures in order to tilt the scales in favour of first-time buyers and against BTL landlords. After the general overhaul of the stamp duty system in 2014, the government added a 3% surcharge on second homes in April 2016.

Furthermore, starting from April this year, BTL landlords are no longer able to reclaim the full amount of mortgage interest paid on their tax return. As landlords will all be aware, until 2020, the amount of mortgage interest that can be deducted will gradually be reduced to zero and replaced with a 20% flat rate rebate. This move will impact the profitability of investments for a large number of private landlords, particularly if inflation rises.

As if that wasn’t enough, the Prudential Regulatory Authority’s tightening in underwriting standards for mortgage lenders will also have an impact on the industry. I understand why they are doing this as they are stressing the importance that in these transactions, all parties involved take risk assessment seriously. They seem particularly worried that previously, investors and lenders haven’t evaluated the profitability of the investment carefully enough. With the Bank of England putting this market in its sights, now the stress is on the integrity of the market.

However, while recent developments in the sector certainly pose challenges for private landlords, strong demand for rental units and capital appreciation still work in favour for those carefully selecting a Buy-to-let property as an investment for the future.

For example, I see that the total amount of rent paid to private landlords in Britain is now more than double the amount of mortgage interest paid to banks by homeowners, as rising house prices push more people into the rental sector. Over the 12 months up to July, those renting paid about £54bn to buy-to-let investors. This is because I suspect that the number of people renting property across the country rises and rents rise.

However, it remains the case that the group most affected by the Government’s changes are the smaller landlords. There is no question but that it is this group who are experiencing the squeeze. The latest figures seem to show that the bigger landlords, those with 4 or more properties are still investing, whist the smaller ones are far less likely to.

I see also that HMRC are now saying that some 40% of private landlords are not now dealing with their tax requirements correctly. It is difficult to know where this is going to end up but it seems to me that there is a drive to professionalise the operators in the market place with these regulatory and other changes complicating the tax treatment and changing the cost base.

It is interesting that the market is adjusting to this and I notice that there seems to be a significant move to buy properties outside London, in areas where the price is low but the rental demand is strong. University towns are a good example of this. After all younger people are responsible for about half of Britain’s total rent bill, paying around £24bn to landlords over the past year.

So although there are genuine issues making it more difficult for the buy to let market, particularly for the small property owners, there are offsetting positives.

Mortgage rates are at record lows and are helping buy-to-let investors make deals stack up and population growth means that there is a growing demand from tenants. Also, rents that should rise with inflation and the long horizon for interest rate rises mean many investors should find the market attractive enough.

Nonetheless, I will still press the Chancellor to think again about the tax changes made by George Osborne which have affected the amount of rental property on the market and I hope with some progress at the next budget.

However for me the biggest danger for everyone would be the arrival of Jeremy Corbyn and his very anti-private property ownership policy agenda. Not only would that be a disaster for this marketplace but also for the UK. Yet that is one for me and my colleagues over the next five years.

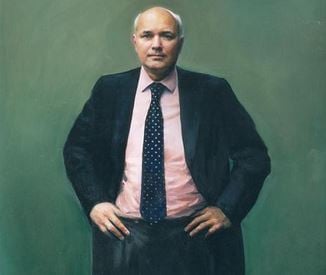

By Iain Duncan Smith

Comments from Tracey Hanbury Editor of Landlord Investment Show and Co-Founder of National Landlord Investment Show add’s

We are inviting you to be part of the UK’s largest Landlord panel debate at the National Landlord Investment Show on Tuesday 7th November at London Olympia. This is a great opportunity for Landlords & Investors to voice their concerns and get valuable feedback from this specialist panel.

The National Landlord Investment Shows have successfully organised 52 exhibitions across the UK providing UK Landlords with key information on ever changing issues. It also provides a great service for all services within the private rented sector providing them with the platform to meet with 1000’s of Landlords & Investors who may require their services including;

Attend the hottest Landlord debate in the 450 seat auditorium with key industry figures and main guest Iain Duncan Smith to get answers on Universal Credit, Brexit, Licencing and mortgage updates.

For more information you can contact Tracey@landlordinvestmentshow.co.uk

Or call the office on 0208 656 5075

Register for your tickets at www.landlordinvestmentshow.co.uk

To subscribe to Landlord Investor Magazine please visit www.landlordinvestormagazine.co.uk

Previous Article

Are my wife and I a property rental BUSINESS?Next Article

DWP is refusing to disclose five reports