9:35 AM, 1st June 2023, About 2 years ago

Text Size

House prices have fallen by 3.4% in the year to May – which is a bigger decline than the drop of 2.7% seen the month before, Nationwide reveals.

The data also shows that prices edged down by 0.1% last month, taking the average property price to £260,736.

The building society says that mortgage interest rates will remain high for longer than was predicted previously.

However, the lender points out that average prices are still 4% below their August 2022 peak.

Robert Gardner, Nationwide’s chief economist, said: “Following tentative signs of improvement in April, annual house price growth softened again in May, falling back to -3.4%, from -2.7% in April.

Robert Gardner, Nationwide’s chief economist, said: “Following tentative signs of improvement in April, annual house price growth softened again in May, falling back to -3.4%, from -2.7% in April.

“However, this largely reflects base effects with prices broadly flat over the month after taking account of seasonal effects.

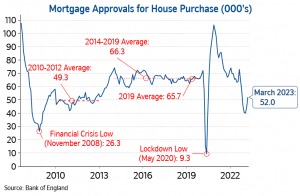

“Recent Bank of England data had shown some signs of recovery in housing market activity, although the number of mortgages approved for house purchase in March was still around 20% below pre-pandemic levels.”

He added: “Headwinds to the housing market look set to strengthen in the near term.

“While consumer price inflation did slow in April, it was a much smaller decline than most analysts had expected.”

Mr Gardener says that the Bank of England’s base rate will peak at 5.5% – higher than the 4.5% predicted in March.

Sarah Coles, the head of personal finance at Hargreaves Lansdown, said: “House prices fell back very slightly in May, but this is a drop in the ocean compared to the flood of bad news that may lie in store if mortgage rates continue rising.

“The change in May is largely due to the seasonal adjustment – because prices were broadly flat. What matters is what comes next.

“Confidence had been slowly building in the property market this spring, as buyers and sellers convinced themselves that the horrors of inflation could be coming to an end, and that mortgage rates might continue to fall.”

Ms Coles adds: “However, higher core inflation figures raised expectations that interest rates may have to keep rising, which forced hundreds of mortgage products to be withdrawn from the market, and major lenders to hike rates.

“It may well have brought confidence crashing down.

“This isn’t going to be a repeat of the horrors we saw in the aftermath of the mini-Budget. The market hasn’t been rocked to anything like the same extent.”

James Forrester, the managing director of Barrows and Forrester, said: “The market has continued to tread water where the current rate of house price growth is concerned and with a further hike to interest rates likely this month, we can expect this subdued performance to remain over the coming months.

“Those sitting on the fence in anticipation of a return to the pandemic glory days of double-digit price growth will be sitting for some time.

“However, the outlook is broadly positive and while a natural correction was always likely, we are yet to see any inkling of a market crash.”

Iain McKenzie, the chief executive of The Guild of Property Professionals, said: “The slowdown in house price growth continues, albeit not at the pace that some buyers may be hoping for.

“It’s clear that there has been a readjustment in the market during the first half of the year, which is unsurprising considering the economic challenges facing the country.

“Prices are levelling off though, and this stability should bring reassurance not only to sellers, but also to buyers that may be worried about their home losing value as soon as they sign on the dotted line.”

He adds: “Property sales are struggling to live up to the frenzied scenes we were seeing this time last year but with mortgage offers picking back up again, the outlook for the rest of the year could be brighter.”

Previous Article

Will selling up be a mandatory ground in the Renters' Reform Bill?Next Article

What do the falling house prices mean for landlords?