11:15 AM, 5th August 2022, About 2 years ago

Text Size

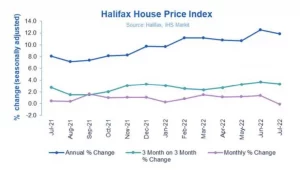

The UK’s house prices fell slightly by 0.1% in July compared with June – that’s the first fall seen since June 2021, according to Halifax.

The lender says that the average home price in July was £293,221 and they are warning that house prices could fall further after the Bank of England raised interest rates this week.

In their latest report, Halifax says that house prices are still £30,000 higher than they were in July 2021.

The managing director of Halifax, Russell Galley, said: “Following a year of exceptionally strong growth, UK house prices fell last month for the first time since June 2021, albeit marginally.

“While we shouldn’t read too much into any single month, especially as the fall is only fractional, a slowdown in annual house price growth has been expected for some time.”

He added: “Leading indicators of the housing market have recently shown a softening of activity, while rising borrowing costs are adding to the squeeze on household budgets against a backdrop of exceptionally high house price-to-income ratios.”

Mr Galley also highlights that some factors that led to the housing market growth through the coronavirus pandemic lockdown, which include homeowners saving money and looking for larger homes and properties in rural locations because of remote and flexible working practices, still remain.

He added: “Looking ahead, house prices are likely to come under more pressure as those market tailwinds fade further and the headwinds of rising interest rates and increased living costs take a firmer hold.

“Therefore, a slowing of annual house price inflation still seems the most likely scenario.”

Mr Galley also warns that there is a ‘significant long-term challenge’ from the ‘extremely short supply of homes for sale’ that will continue to underpin high property prices.

News of a potential slowdown in house price inflation comes after the Bank of England unveiled its largest interest rate increase in 27 years this week.

That move was aimed at curbing soaring inflation and interest rates were increased to 1.75%, from 0.5%.

The Halifax report highlights that Wales has moved back to the top of the table for annual house price inflation – up by 14.7%, with an average property price of £222,639.

The Halifax report highlights that Wales has moved back to the top of the table for annual house price inflation – up by 14.7%, with an average property price of £222,639.

It is closely followed by the South West of England, which also continues to record a strong rate of annual growth, up by 14.3%, with an average property cost of £310,846.

The rate of annual growth in Northern Ireland eased back slightly to +14.0%, with a typical home now costing £187,102.

The lender says that Scotland too saw a slight slowdown in the rate of annual house price inflation, to +9.6% from +9.9%. A Scottish home now costs an average of £203,677, another record high for the nation.

And while London continues to record slower annual house price inflation than the other UK regions, the increase of 7.9% is the highest in almost five years.

With an average London property now costing £551,777, the capital’s already record average house price continues to push higher, up by £40,361 over the last year. It remains by far the most expensive place in the country to buy a home.