16:45 PM, 17th August 2022, About 2 years ago 4

Text Size

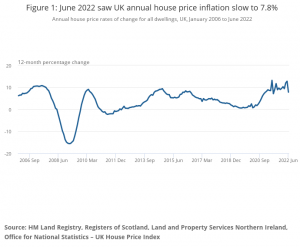

The UK’s average house price increased by 7.8% in the year to June 2022, the latest data from the Office for National Statistics (ONS) reveals.

And the ONS has also announced that the rate of annual inflation to July has hit double digits – and is now at a 40-year high.

The House Price Index (HPI) shows that despite house prices rising between May and June 2022, annual house price inflation has slowed due to the rises in prices seen in June 2021, which were the result of tax break changes.

The average house price in June for the UK was £286,000 – that’s £20,000 higher than this time last year.

When the figures are broken down, house prices in England grew by 7.3% to £305,000, in Wales they rose by 8.6% to £213,000 and in Scotland prices rose to £192,000 a rise of 11.6%.

When the figures are broken down, house prices in England grew by 7.3% to £305,000, in Wales they rose by 8.6% to £213,000 and in Scotland prices rose to £192,000 a rise of 11.6%.

In Northern Ireland house prices increased by 9.6% to £169,000.

The ONS says that part of the reason for the annual increase is a backlog of sales after the Covid-19 lockdown. HM Land Registry is focused, it says, on registering land and recording prices. They point out that the figures published may be altered in future.

They also add that the latter half of 2020 saw the UK’s average house price growth accelerating.

This trend continued into 2021, and house price growth has remained strong since the start of 2022.

When England’s figures are broken down, the East of England was the region with the highest annual house price growth, with average prices increasing by 9.7% in the year to June 2022. This was down from a growth rate of 14.5% in May 2022.

The lowest annual house price growth was in the North East, where average prices increased by 3.6% over the year to June 2022, down from 10.9% in May 2022.

London’s average house prices remain the most expensive of any region in the UK, with the average house price now at a record level of £538,000 in June 2022.

The North East continued to have the lowest average house price at £158,000.

The ONS says that the 10.1% rise in the inflation rate reflects price rises across many parts of the Consumer Prices Index (CPUI).

The CPI is up from June’s 9.4% figure and is the highest annual CPI inflation rate seen since January 1997.

Food and non-alcoholic beverages, and transport made the largest upward contributions to the monthly rates in July 2022 – whereas in June 2021, the main upward rise came from transport.

Notable increases include motor fuel rising by 43.7%, and non-alcoholic drinks and food rising by 12.7%.

Commenting on the latest data, Hargreaves Lansdown senior personal finance analyst Sarah Coles, said: “Inflation has broken through double-digits, hitting another 40-year high.

“The rise in the price of life’s essentials is causing horrible problems for millions of people, as the cost of energy and food soars. What’s even more worrying is that this isn’t the last of it.”

She added: “The Bank of England now expects inflation to peak at 13% later this year and stay higher for longer. It means the pain is far from over.

“These figures are likely to fuel speculation of another 0.5 percentage point interest rate rise next month, piling pressure on borrowers. The bank is trying to bring core inflation down – a measure that strips out energy and food prices which are at the mercy of global markets.”

Beaver

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up9:54 AM, 18th August 2022, About 2 years ago

The interest rate rise won't just pile pressure on peoples mortgages; as a consequence of the government shutting the country down during the Covid outbreak small businesses have unprecedented levels of debt. If the Bank continues to raise interest rates it will create a recession.

DGM

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up11:15 AM, 18th August 2022, About 2 years ago

I do wonder about these so called experts, there is years of past data to show raising interest rates will not work. The inflation is caused by high energy costs making food costs increase. Raising interest rates will only make people stop buying so more businesses will go bust and cause a major recession.

This is not caused by spending, if anything they need to reduce interest rates again to allow people a little extra they can spend in the economy. They are deliberately causing a recession.

Beaver

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up13:03 PM, 18th August 2022, About 2 years ago

Reply to the comment left by DGM at 18/08/2022 - 11:15

Agreed. I was chatting to two friends last night about their experience of lockdown. One is a husband and wife couple who had no income for an entire year during lockdown. Another is a single mum who had no income for a year during lockdown. People who weren't classified as "key workers" (whatever that meant) often had to exhaust their savings and max out their debt to get by.

Small businesses also took on unprecedented levels of debt during the Covid outbreak:

https://www.fsb.org.uk/resources-page/small-firms-call-for-help-with-unmanageable-debt-burden-as-lending-tops-100bn.html

The FSB says that banks are already "pulling up the drawbridge" on small businesses:

https://www.fsb.org.uk/resources-page/lending-to-small-businesses-hits-all-time-low-new-study-finds-with-six-in-ten-impacted-by-late-payment.html

According to FSB 11% of small businesses are planning to close.

But in the wake of the last financial crisis it was small businesses that created the employment. If the BOE continually raises interest rates it is turning the screw on the small business community.

Smaller landlords of course weren't given any compensation during Covid. They aren't just going to sit there take the hit and do nothing if their mortgage interest rates become unsustainable.

The Forever Tenant

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up9:14 AM, 19th August 2022, About 2 years ago

Isn't the idea of raising interest rates so that people will put their money into savings instead of spending it? Thus restricting the money flowing through the economy and slowing down inflation?

It would seem that the current issues with inflation are nothing to do with spending, so raising interest rates to any amount would have no effect.