10:18 AM, 15th December 2021, About 3 years ago 1

Text Size

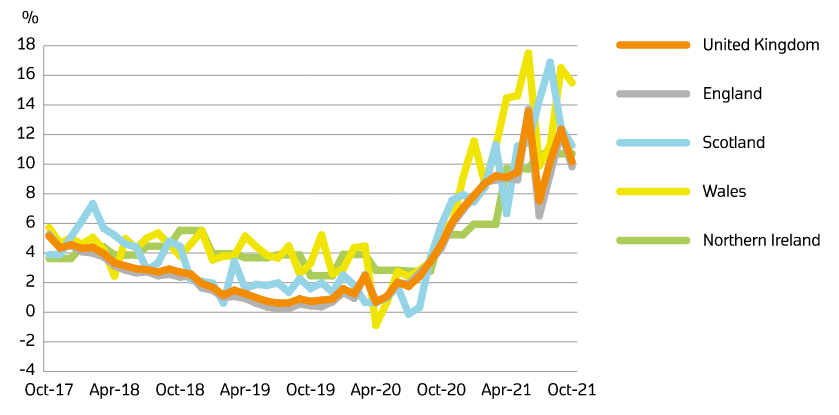

The HM Land Registry House Price Index released today for October is indicating the average price of a property in the UK is now £268,349 up 10.2% from last year. Month-on-month October saw prices actual fall 1.1%. However, the monthly index figure compared to baseline January 2015 of 100 for the UK was 140.7.

At the country level, the largest annual house price growth in the year to October 2021 was recorded in Wales, where house prices increased by 15.5%.

Scotland saw house prices increase by 11.3% in the year to October 2021.

England saw house prices increase by 9.8% in the year to October 2021.

Northern Ireland saw house prices increase by 10.7% over the year to Quarter 3 (July to September) 2021.

The Royal Institution of Chartered Surveyors’ (RICS) October 2021 UK Residential Market Survey reported buyer demand picking up slightly. The lack of available supply presents buyers with a limited choice and remains a key factor in strong house price growth.

The Bank of England’s Agents summary of business conditions 2021 Q3 reported ongoing strong demand for housing across most parts of the UK and a shortage of properties for sale, which pushed up prices.

The UK Property Transactions Statistics showed that in October 2021, on a seasonally adjusted basis, the estimated number of transactions of residential properties with a value of £40,000 or greater was 76,930. This is 28.3% lower than a year ago. Between September and October 2021, UK transactions decreased by 52.0% on a seasonally adjusted basis, following a large increase in the month prior.

The Bank of England’s Money and Credit October 2021 release reported that mortgage approvals for house purchases (an indicator of future lending) in October 2021 was 67,200, which is down from 71,900 in September 2021.

Managing Director of Sirius Property Finance, Nicholas Christofi, commented: “Although the end of the stamp duty holiday and a potential increase in interest rates is expected to cause a market slowdown early next year, we’re unlikely to see any notable reduction in buyer demand and therefore house price growth should remain steady, at the very least.

“A potential interest rates increase will cause many buyers to pause for thought before transacting. However, we’re already seeing measures to reduce this impact with the Bank of England removing the mortgage rates rise stress tests and a number of mortgage providers already starting to offer some very favourable deals.”

Managing Director of Barrows and Forrester, James Forrester, commented: “A marginal decline following the final curtain of the stamp duty holiday was always on the cards but a one per cent monthly drop is far from the market collapse that many have been expecting.

“The real proof in the pudding is the annual rate of appreciation and this is the third consecutive month where house prices have climbed by more than ten per cent year on year.

“Based on the market trends seen following the initial stamp duty holiday deadline, we can expect house prices to bounce back on a monthly basis ahead of the Christmas break, as many push to complete before Santa comes to visit.”

Bective’s Head of Sales, Craig Tonkin, commented: “While we’re now starting to see signs of the market cooling across some areas of the UK, London continues to build momentum with one of the strongest rates of monthly house price growth of all regions.

“This has been driven by an influx of foreign interest at the top end of the market and we’re seeing larger family homes, in particular, go under offer at pace due to a severe shortage of supply.

“With growing demand for London homes, the capital looks set to enjoy a sustained level of house price growth throughout the remainder of the year and well into 2022.”

Previous Article

Law student sues landlord - But wait?Next Article

The PERFECT Property Investment Strategy For 2022

TheMaluka

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up11:16 AM, 15th December 2021, About 3 years ago

How can the Land Registry issue any recent statistics when they are taking a year or more to process registrations? A Government Quango which over the last few years has gone from one of the best, if not the best, to the worst. Can this be anything to do with closing all the local offices?