9:43 AM, 13th July 2018, About 7 years ago 12

Text Size

I have encounter an problem on EPC and CO2 emission:

I received latest EPC on the property I am proposing to purchase today:

1. The EPC is D on the front page next to the color chart

2. However its CO2 emission is F on the last page

3. Due to this reason the surveyor said this property is unmortgageable.

My questions are:

1. Is there new rules and regulations ?

2. Is CO2 emission is taking into account – hence need minimum E as well?

As from my understanding the EPC rating is indicated by the color chart which is D in my case.

Any advice and help will be greatly appreciated.

Many thanks

phoebe

Editors Note:

Click Here to see full article below

From April 2018 under the Minimum Energy Efficiency Standards (MEES) it will be unlawful in England and Wales to grant a new tennacy on a property with an Energy Performance Certificate (EPC) of less than E.

The Department for Business, Energy and Industrial Strategy have issued guidance for landlords and local authorities, because it is believed up to 1 in 20 properties would not achieve and EPC rating of E.

Click Here to see the full guidance.

The Energy Efficiency Regulations 2015 are designed to tackle the least energy efficient properties in

England and Wales – those rated F or G on their EPC. The Regulations establish a minimum standard for both domestic and non-domestic privately rented property, effecting new tenancies from 1 April 2018.

It will be local authorities that are tasked with enforcing the new minimum energy efficiency ratings.

An EPC lodged with the EPC register will be valid for 10 years so there will be no need for a new EPC for each new tenancy.

The current domestic regulations are based on a principle of ‘no cost to the landlord’, this means that landlords of F or G rated homes will only be required to make improvements to these properties where they can do so entirely using third party finance from one or more sources.

No EPC – No Mortgage Click Here:

From April 2018, BTL landlords might find it far more difficult to get buy to let mortgages if their properties don’t have the right Energy Performance Certificate rating

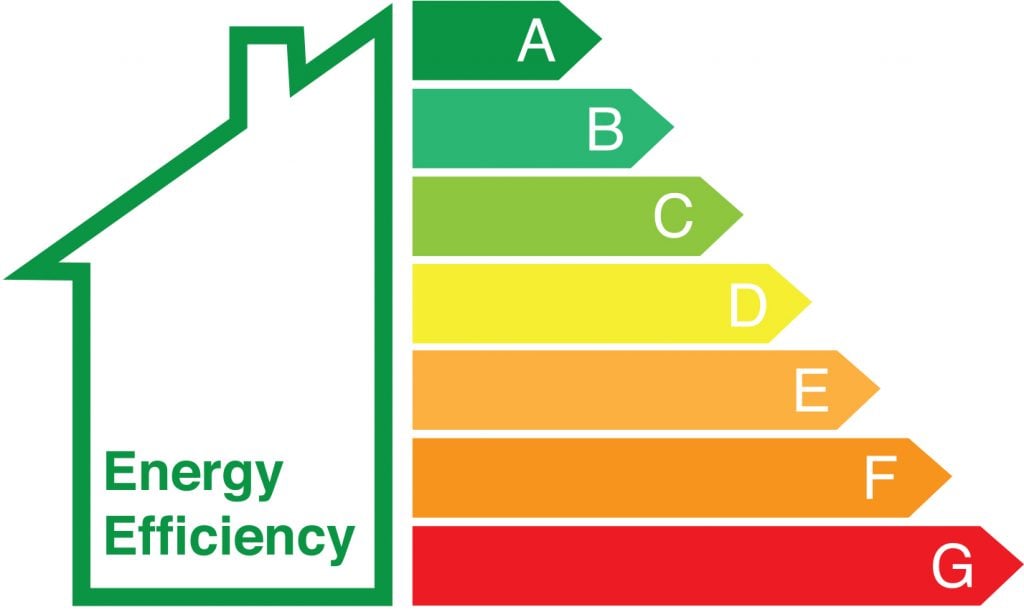

EPC’s are rated from A (the most energy efficient property) down to G.

Energy Performance Certificates (EPCs) include detailed information about the subject property’s energy output and cost ratings. EPC’s are currently required when a property is rented or sold and they are valid for 10 years.

An EPC must be ordered before the property is rented or sold.

LATEST UPDATE – as from 1st April 2018, BTL landlords will not be allowed to issue a new or renewal tenancy if the property’s EPC rating is F or G.

AND …. as from 1st April 2020, it will be illegal for landlords to continue to let the property if the EPC has a rating of F or G.

The dates may be April 1st, but these are no joke. Breaching these new rules could mean fines of up to £5,000 may be imposed.

AND – these new rules are not only crucial from an energy compliance angle but they are also important when looking for buy to let (purchase or remortgage) mortgage deals.

From April 1st (and maybe sooner if lenders implement the new checks beforehand) BTL borrowers should expect to submit a valid EPC with an agreeable rating. If this is not possible, the mortgage application may be refused.

Maintaining a valid EPC may also be written into your mortgage contract conditions, too. And to add to these issues as well, surveyors may even down-value properties which have unsatisfactory EPC ratings.

Previous Article

Eviction of travellers: Writ of possession or common law?Next Article

Section 24 Billboard Campaign Heads North

Laura Delow

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up18:46 PM, 16th July 2018, About 7 years ago

My pleasure Phoebe

MasterG

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up19:15 PM, 16th July 2018, About 7 years ago

But, as stated previously, CO2 emissions by themselves are not a reason to withold a mortgage on a residential property. You have paid for that valuation and are within your rights to demand that the valuer explains his reasoning.