14:40 PM, 11th November 2015, About 9 years ago

Text Size

GENERAL GUIDANCE

If you have been retaining profits after paying the higher rates of income tax then you have probably been paying more tax than necessary.

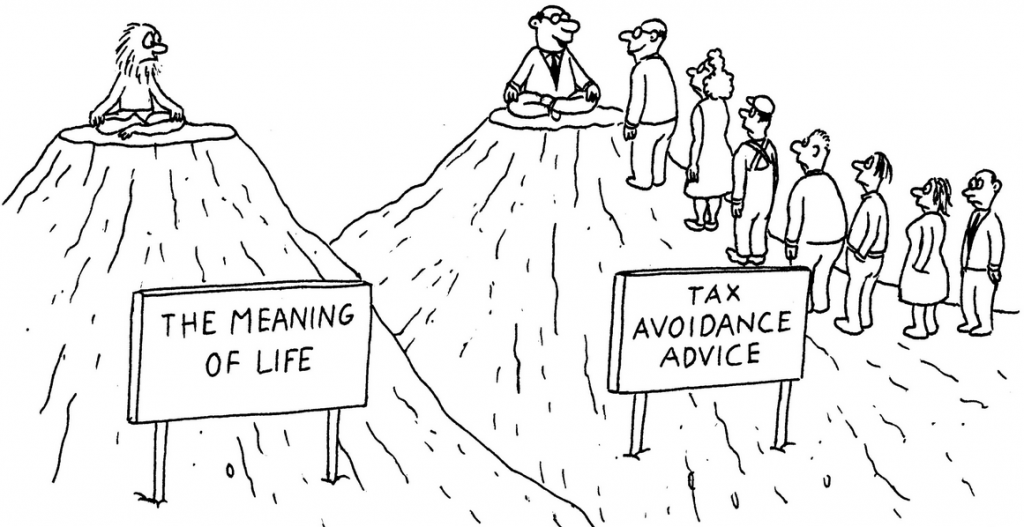

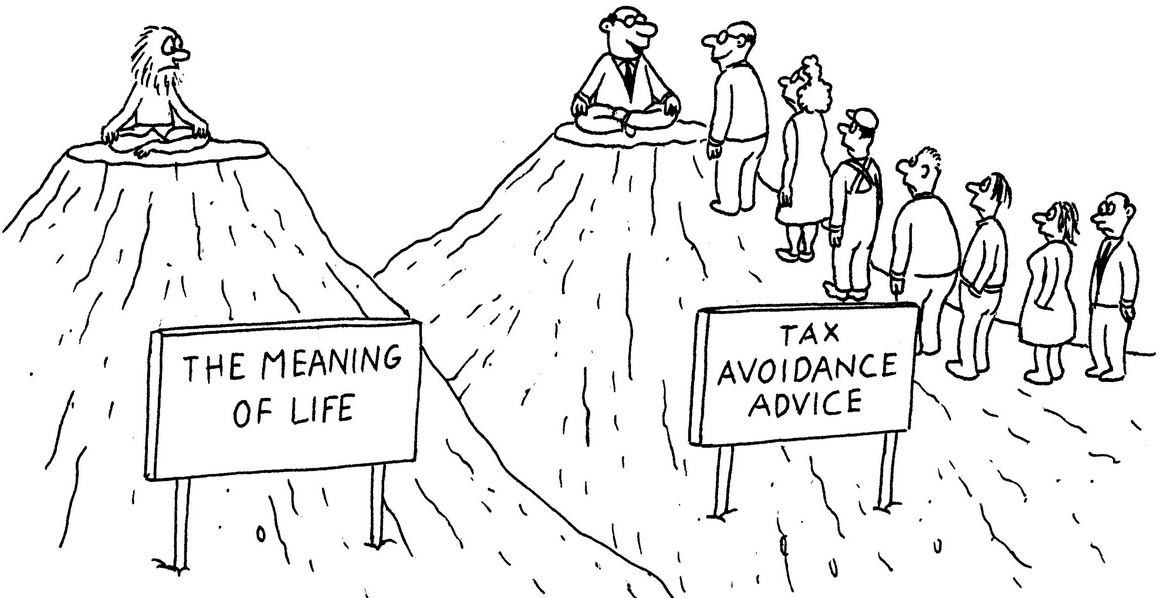

IS TAX AVOIDANCE LEGAL?

The law regarding tax avoidance was clarified nearly 80 years ago.

In 1936 a landmark legal case was heard in the House of Lords (Inland Revenue Commissioners v Duke of Westminster [ 1936 ] AC1 (HL)). The Duke of Westminster won the case. The judge, Lord Tomlin, stated:

“Every man is entitled if he can to arrange his affairs so that the tax attaching under the appropriate Acts is less than it otherwise would be. If he succeeds in ordering them so as to secure that result, then, however unappreciative the Commissioners of Inland Revenue or his fellow taxpayers may be of his ingenuity, he cannot be compelled to pay an increased tax.”

The latter part of Lord Tomlin’s statement could so easily be applied today to the unpopular tax strategies used by the likes of Amazon, and indeed the advice that landlords could be made privy to.

WHAT ABOUT GAAR?

HMRC now has a very powerful weapon called General Anti Abuse Rules. It is GAAR which renders the vast majority of tax avoidance ideas discussed on internet forums as ineffective. The arrangements I have outlined below are not affected by GAAR.

An important question you must be able to answer in regards to any tax planning is this; why did you put this arrangement in place? If the only credible answer you can offer is ‘to save tax’ then you are immediately on the back foot. Therefore, it is extremely important that you understand all of the commercial benefits of any strategy that you decide to implement. Quality advice will ensure that you do.

BEWARE INSPIRED AMATEURS

It is important to recognise that for every effective tax planning arrangement there is likely to have been 10’s if not 100’s of thousands of pounds spent on professional fees considering the tax law and producing the correct supporting documentation.

People dream up new ‘tax schemes’ every day, most of which can be pulled apart within minutes by a good tax expert. There have been plenty ideas discussed on Facebook and other forums on how to mitigate the effects of Restrictions on Finance Cost Relief. The ideas that pass the initial professional common sense tests then begin to incur huge fees. The chances of success are probably no greater than a sperm has to fertilise an egg. This is why it pays to obtain professional advice and to consider strategies which are already proven. Some people chance their arm in terms of tax strategies and most of these end up much worse off, often bankrupt.

TAX PLANNING STRATEGIES THAT ARE EFFECTIVE

As regular readers of Property118 are aware, I work as a Consultant for a firm of Chartered Accountants which specialises in advising property people, as well as three Solicitors practices and a Barristers Chambers. I am a retired commercial finance broker and co-founded a commercial finance business in 1990 which ranked at #38 in The Sunday Times Profit Track 100 in 2008. I was also a founder member of the NACFB (National Association of Commercial Finance Brokers) which is a professional body whose members are responsible for arranging Billions of pounds worth finance every year.

I can assure you that we have left no stone unturned in terms of investigating solutions to avoid the finance cost restrictions, hence we are now in a position to advise you on all strategies you may have considered or read about elsewhere.

How we can help:-

Avoid the increased tax consequences of finance cost restrictions for individual landlords.

When incorporation is implemented correctly the following benefits are available:-

The only strategies we recommend are those which are able to be fully disclosed to HMRC.

Advance voluntary clearance may be obtained via HMRC prior to implementation.

Our recommended professional advisers are fully regulated and insured to provide and implement the advice.

We DO NOT recommend strategies requiring the use of offshore trust companies.

Our Tax Consultancy Service

The service we provide includes:-

This service is available for a fee of £1,995 including VAT, which is the same as our normal Consultancy fee. It exists to enable you to clearly establish how much extra tax you will pay if you do nothing vs knowing what the best solutions are, how much they will save you and the costs of implementation. You will then be in a position to make informed commercial decisions.

I am very confident the solutions we suggest will save you considerably more money (inclusive of costs of implementation) than you will otherwise pay to HMRC as a result of doing nothing. In other words, the solutions will be commercially viable.

If you would like to use the Property118 Tax Consultancy Service described above please complete our fact find, booking and payment form below.

Alternatively, please call me on 01603 428 501 or send me an email to mark@property118.com

Yours sincerely

Mark Alexander – founder of Property118.com

Previous Article

Mydeposits to operate a custodial scheme