13:16 PM, 22nd November 2023, About A year ago 28

Text Size

Chancellor Jeremy Hunt has revealed that the Local Housing Allowance (LHA) will be unfrozen – and the rate will increase to the ’30th percentile of local market rents’.

Mr Hunt told MPs ‘I have listened’ to landlords and tenant organisations before he unveiled the increase.

The chancellor said that rent can account for more than half of the living costs of renters on the lowest incomes.

It is the first increase in LHA since April 2020.

He told MPs: “This will give 1.6 million households an average of £800 of support next year.”

The move to unfreeze LHA will be welcomed by landlords and tenant groups who have campaigned for the move to help low-income families find homes to rent.

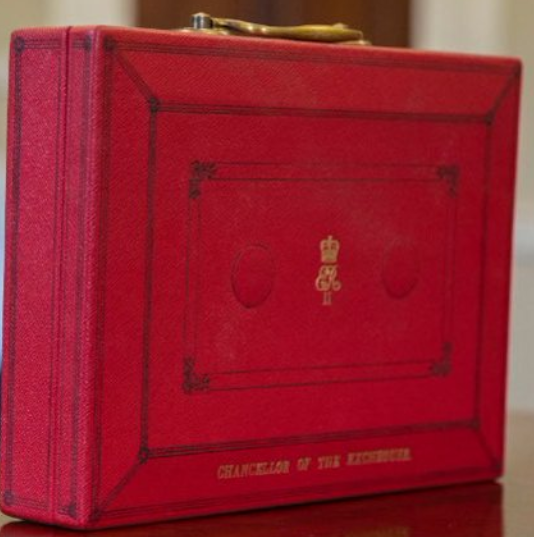

The announcement was part of the Autumn Statement to spell out the government’s tax and spending plans in the House of Commons.

The chancellor also said that the Office for Budget Responsibility (OBR) had found his statement will be good for business investment – and it will get more people into work.

The OBR also reveals that inflation in the UK will fall to 2.8% – which helps to explain why lenders say their interest rates won’t be falling soon.

Also, the government will increase Universal Credit and disability benefits by 6.7% – which is in line with September’s inflation rate.

There will also be a consultation on a change to permitted development rights to allow ANY house to be converted into two flats – so long as there is no change to the external appearance.

Reactions from the private rented sector (PRS) include:

Gavin Richardson, the managing director of BTL broker Mortgages for Business, said: “What the housing sector needed was an Autumn Statement that supported landlords. Instead we’re still stuck in landlord limbo.

“Plans to abolish Section 21 ‘no-fault’ evictions in the Renters (Reform) Bill are still on hold as we wait for the court system to be reformed.

“Currently, it takes six months for landlords to regain possession of their property following a legitimate claim.”

He added: “Landlords have lost confidence in the courts and are concerned about the security of their investments without Section 21 in place.

“We want the government to set an eight-week target for processing times for possession claims before abolishing Section 21.”

Managing Director of Final Duties, Jack Gill, commented: “Hopes of a inheritance tax cut have been dashed today, with the government instead choosing to pander to the masses in order to boost popularity ahead of the next general election.

“This is disappointing given that inheritance tax is no longer a tax on the wealthy and more and more of us face falling foul of it as our estates grow in value and become liable.

“This is largely due to the over stimulation of the property market in recent years which has pushed house prices to record highs. With property forming the majority of the average person’s estate, the increase in the value of their property is pushing them into inheritance tax territory.

“Given that the government is largely to blame for such an out of kilter housing market, you’d have thought they would make amends by reducing their inheritance tax grab – a grab that has seen the total sum of receipts paid increase by 17% in the last year alone.”

Ben Twomey, the chief executive of Generation Rent, said: “The unfreezing of Local Housing Allowance will help the one in three private renters who rely on benefits to cover their rent. We have faced a cost of renting crisis since LHA was last increased in March 2020, and those of us relying on benefits have had to cut back even further on food and heating in order to stay on top of rent.

“Not all renters will get the support we need from this announcement – families caught by the benefit cap won’t get an extra penny – and tenants who need to find a new place to live will still struggle to afford current market rents, which have risen much faster than even the new LHA rates.”

He adds: “That means that if your landlord evicts you, you could still face having to go to the local council for homelessness support.

“We need more action from the government to reduce the number of evictions, build more homes in places people want to live, and to make sure that Local Housing Allowance keeps up with rents, rather than being frozen yet again.”

Director of Benham and Reeves, Marc von Grundherr, said: “Another underwhelming Autumn Statement where the housing market is concerned. Much like unwrapping a pair of socks on Christmas Day, it lacked imagination and left us feeling largely disappointed.

“It’s clear they have run out of ideas when it comes to addressing the current issues plaguing the property market. Hardly surprising when we have housing ministers coming and going more frequently than the postman.”

The chief executive of Octane Capital, Jonathan Samuels, said: “Today’s budget was a missed opportunity to help kick start a property market that has been looking a tad lethargic of late.

“Higher mortgage rates and wider market uncertainty have caused the market to cool as a result of a drop in buyer activity and we were hoping that the government would offer up an incentive to entice them back into the fold.”

The managing director of House Buyer Bureau, Chris Hodgkinson, said: “We’ve grown accustomed to the government announcing housing market incentives designed to fuel demand and so an absence of any such initiative today will come as a shock. Instead, they’ve uncharacteristically decided to address the burning issue of supply.

“While this will do little to ignite the property market in the short term, it will be beneficial in the long run, provided they actually deliver on their promises.”

Jeremy Leaf, a north London estate agent and a former RICS residential chairman, said: “We would have liked to have seen more direct help to encourage landlords in particular to stay invested and add to their portfolios, bearing in mind so many are providing accommodation for tenants on housing benefit on behalf of local authorities.

“Affordable accommodation remains in short supply, particularly affordable rental accommodation and there are no signs that this will change any time soon.”

Neil Cobbold, managing director of Payprop, said: “At a time when parliament is busy debating tougher regulations for the private rented sector, it is disappointing that the Chancellor has not used this opportunity to either allow landlords to deduct costs, including mortgages, from rental income, or to provide other financial support to encourage them to keep their properties in the PRS.

“While the reduction in inflation will eventually reduce mortgage costs, it may be too late for landlords who are already defaulting on their buy-to-let mortgages. The latest stats from the government show an 11% increase in repossessions.”

He added: “Other announcements may have an impact on the PRS, but not immediately, including a new permitted development right allowing property owners to convert a house into two flats, and an allocation of funds to planning reform, designed to speed up the delivery of new housing.”

Mr Cobbold welcomed the unfreezing of the local housing allowance but said more support needs to be targeted to the most vulnerable in the PRS.

He said: “It is encouraging to see the Chancellor has considered the industry’s input and raised the local housing allowance to the 30th percentile of local market rents. However, it is important that these figures are based on real rental price data that truly reflect the local cost of renting.

“General tax and spending concessions announced today may aid tenants, but more targeted support is needed for the most vulnerable private rented sector (PRS) tenants. A 2% cut to the national insurance rate will reduce tax for tenants earning over £12,570 a year, while the minimum wage increase to £11.44 per hour from April will help others. However, fiscal drag due to income tax bands not rising with inflation may well wipe out some of these savings.”

Tom Goodman, managing director at Vouch, said: “Although many landlords had been lobbying for the abolition of Section 24 as part of this announcement, no such offer was forthcoming. However, some landlords and agents will benefit from tax cuts for the self-employed.

The 2021 English Private Landlord survey estimated that 39% of landlords with five or more properties were self employed, meaning many landlords with larger portfolios will access this tax break. The cuts also include an abolishment of class 2 national insurance for self-employed people earning more than £12,570. Taken together, these measures will save self-employed landlords and letting agents up to £350 a year, and we hope the Government continues to push ahead to provide more tangible support designed to keep landlords in the market.”

National Association of Property Buyers, Spokesman Jonathan Rolande said: “The Local Housing Allowance increase is to be welcomed, rents have increased dramatically in recent years and a higher allowance means tenants will be more able to keep up with their rent payments.

“That said, it may be seen by some landlords as an opportunity to push up rents even further, fuelling inflation in the sector.

“The announcements around planning were not predicted and came as a surprise. Making homes easier to split makes good sense – two households in the space of one – but in reality few homes lend themselves to this kind of conversion and the cost of work can be very high. We won’t see the opportunity taken by most owners.”

Ben Beadle, chief executive of the National Residential Landlords Association, said: “We warmly welcome today’s announcement by the Chancellor, which follows extensive campaigning by the NRLA and others.

“Freezing housing benefit rates was always a disastrous policy, hitting as it did many of the most vulnerable tenants across the private rented sector. Taking steps to reverse this change will provide vital support for tenants who are in receipt of the LHA, making it easier for them to access and sustain rental tenancies. More generally, this will go a long way towards tackling homelessness across the UK.

“All parties now need to commit to ensuring housing benefits are uprated each year so that they continue to be linked to market rents.”

GlanACC

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up19:54 PM, 22nd November 2023, About A year ago

Interestingly, the pundits reckon that there will have to be custs in public services. The courts system is also pencilled in for further cuts. May mean S21 wont be abolished any time soon.

Crouchender

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up20:53 PM, 22nd November 2023, About A year ago

Reply to the comment left by Whiteskifreak Surrey at 22/11/2023 - 18:42Revoke S24 would be immediately be reinstated by Labour anyway so no chance.

I don't expect anything as a LL in Spring either as Labour would push anti LL narrative to their electoral advantage so Conservatives will have nothing to gain with tax relief/sweetners for LLs (due to RRB) from the tenant vote.

Whiteskifreak Surrey

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up6:25 AM, 23rd November 2023, About A year ago

Reply to the comment left by GlanACC at 22/11/2023 - 19:54

That is unless they Cons change their mind and push for S21 abolishment.

Or we will have Labour at tge helm, in which case S21 will apply immediately.

Gromit

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up8:24 AM, 23rd November 2023, About A year ago

Reply to the comment left by GlanACC at 22/11/2023 - 19:54

Labour won't give a damn about Court delays for Landlords possession cases, and will push the abolition of Sec. 21 through a quickly as possible.

Reluctant Landlord

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up9:13 AM, 23rd November 2023, About A year ago

Reply to the comment left by Gromit at 23/11/2023 - 08:24

I see that but as far as my understanding goes if there is a change in government then all planned legislation that has not gone through all the various stages, has to effectively start again? Or can Labour potentially still run with the policy as is?

I thought they wanted to make more substantial changes to it anyway, so wont that mean they have to start the process again from the start anyway?

If that is the case then the RRB still wont be passed for ages yet...

Can anyone clarify this???

Reluctant Landlord

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up9:16 AM, 23rd November 2023, About A year ago

Reply to the comment left by Whiteskifreak Surrey at 23/11/2023 - 06:25

for all the rhetoric I am not sure that they can do it immediately. Surely there has to be a consultation/committe stage first? I thought as the S21 is not a standalone bit (and is only part of the RRB) then all stages of the RRB have to be gone thorugh first???

Crouchender

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up9:53 AM, 23rd November 2023, About A year ago

Reply to the comment left by Reluctant Landlord at 23/11/2023 - 09:16THEY CAN DO VIA OLD COVID EMERGENCY LEGISLATION ! As Scotland did. ie. Ban evictions for 12 months+ as part of the 'renting crisis.'

As RRB gets closer to becoming passed. Expect a flood of S21 anyway as LLs fear will increase so by default a crisis will be manufactured organically via this fear.

Imagine Labour then inheriting this 'Emergency renting crisis' blamed on Tories so their narrative for S21 bans within days in office is credible. They can keep the eviction ban for years if they want to keep people housed until they decide they want their own RRB with every tenant friendly policy bolted to it.

Easy rider

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up10:11 AM, 23rd November 2023, About A year ago

Reply to the comment left by Whiteskifreak Surrey at 23/11/2023 - 06:25

Even if (when) Labour gain power, Section 21 cannot be scrapped immediately. It still needs a Bill to overcome the hurdles in both Houses. The hurdles in the Commons may be small but the Lords is awash with unelected Peers from numerous failed Tory MPs.

I have little doubt that S21 will be abolished (and rightly so in my opinion) but it will take a year or two to achieve. The rise in Section 8 evictions will be a good thing for landlords and a bad thing for tenants. Also, the loss of landlords will also be a bad thing for tenants.

Gromit

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up10:39 AM, 23rd November 2023, About A year ago

Reply to the comment left by Reluctant Landlord at 23/11/2023 - 09:13

Yes any bills that don't complete all stages by the end of a parliament fall. But Labour could re-introduce it afresh (proabaly with a new name and shuffles clauses to make it non-Tory). Or introudce a simplified version with just Sec.21 abolished.

Labour don't give a damn about Landlords so the fact that Sec.8 doesn't even allow you to evict in order to sell they won't care about.

Cue, mass exodus of Landlords and corresponding mass evictions in the weeks before a Geenral Election.

Gromit

Become a Member

If you login or become a member you can view this members profile, comments, posts and send them messages!

Sign Up10:41 AM, 23rd November 2023, About A year ago

Reply to the comment left by Easy rider at 23/11/2023 - 10:11

They'll probably introduce an eviction ban ala SNP/Scottish Government to quash the mass exodus of Landlords & consequential evictions.